$250,000 is the new $50,000

CPI data is set to release on Friday where investors are expecting an 8.3% report vs. an 8.3% previous report. Inflation is starting to hit almost every sector across the board with gasoline hitting as high as $6.37 cents here in California on average vs. the $4.82 national average, I just paid $6.19 for mine sadly. It seems that no one is safe, not even those making large income.

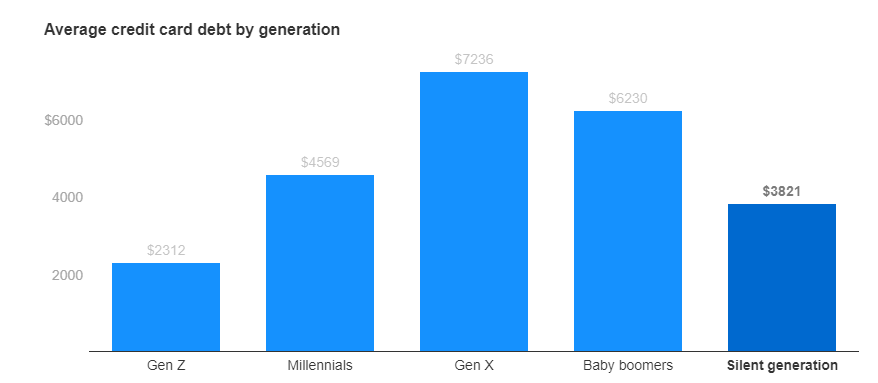

In America, 5% of the population makes over $250,000 a year and according to LendingClub, 36% of them are living paycheck to paycheck. One in ten of those households reported “struggling” to pay their household expenses in April. This is likely due to the rise in home prices over the past few years, but still, it is questionable where all the money goes. Expensive lifestyles may lead to more credit card usage which in turn adds to the monthly cost but even then it comes down to not spending the money if you don’t have it. According to the Fed, Americans are continuing to lean on credit cards and loans, as consumer credit surged by $38 billion in April. As for the rest of the country, 78% of Americans stated they were “doing okay” during the inflation crisis, which is the highest report since 2013. However, one in nine respondents said they wouldn’t be able to cover a $400 emergency. Retail giants are also facing pressure.

Target trimmed its near-term forecasts on Tuesday, June 7th, as it looks to offer massive discounts to combat inventory issues. The new report came in at around 2%, following the 5.3% reported during their earnings report. The company stated it was carrying too much inventory in several categories where the slowdown in sales was more pronounced than expected, lol. “Target’s business continues to generate healthy increases in traffic and sales, despite sustained volatility in the macro-environment, including shifting consumer buying patterns and rapidly changing operating conditions,” said CEO Brian Cornell. “Since we reported our first-quarter results, we have continued to monitor external conditions and have determined the necessary actions to remain nimble in the current environment.”

What are some takeaways from all of this? During the pandemic, most companies, like Walmart, Amazon, and Target faced supply chain issues that lead to some shortages, and now with the supply chain fixing itself, these companies are facing an overhaul of inventory that was misrepresented by “strong” demand early on during the pandemic through 2021. A similar situation is happening with oil and airlines, kind of. Oil prices continue to rise as tensions overseas linger. Comedically, the oil production here in the United States was cut back due to the pandemic and diminished demand but now that the demand is back, supply is shot, and no one is inside anymore, so prices continue to skyrocket. Airlines are facing, and benefiting, from excess demand. Airline companies are reporting record bookings as the travel frenzy is picking back up, so much so that some are facing a shortage of pilots. Delta Chief Executive Officer Ed Bastian told reporters Wednesday in New York the airline is working to train new employees “as we’re seeing historic surging demand.” (Yahoo)

Funny enough, the other side of the coin isn’t as kind. While consumer stocks, staples, utilities, and energy continue to benefit from a surge in demand, tech companies are wiping out their workforce as poor earnings reports and interest rate hikes cripple companies. In the month of May, nearly 16,000 tech workers were laid off. For the month of June, the number isn’t going to be any prettier. Coinbase stated last Thursday that it will extend its hiring freeze and revoke accepted offers from some candidates who haven’t started their roles yet, lol. “Adapting quickly and acting now will help us to successfully navigate this macro environment and emerge even stronger, enabling further healthy growth and innovation,” Chief People Officer L.J. Brock wrote in a company memo, shared publicly on Coinbase’s blog. Tesla is on the bandwagon as well with Elon Musk announcing a hiring freeze in a leaked email reported by Reuters. These are just two examples of many companies cutting back on their workforce after conducting mass hires in the past two years while the market nearly doubled.

It is apparent that the market needs to go into some sort of a recession to rebalance everything but it is hard to determine when and if it will even happen. There are misunderstandings when it comes to this “bubble” and the one from 2008. The housing crash of 08’ stemmed from adjustable rates taken by unsuspecting buyers that eventually rose too much to be affordable whereas in this case, we are facing high inflation, high demand, somewhat questionable supply, and high(er) interest rates.

Thanks for reading and if you made it this far, make sure you follow @glizzyoptions & @yuppiecapital on Twitter.