Inflation Is Yesterday’s Problem

Although U.S. inflation closed at its fastest rise in four decades, we are in the beginning of stages of a downward trend. The Labor Department reported Wednesday that inflation had edged down to 8.3%, down from the massive 8.5% print that we saw last month (when we sanctimoniously called peak inflation).

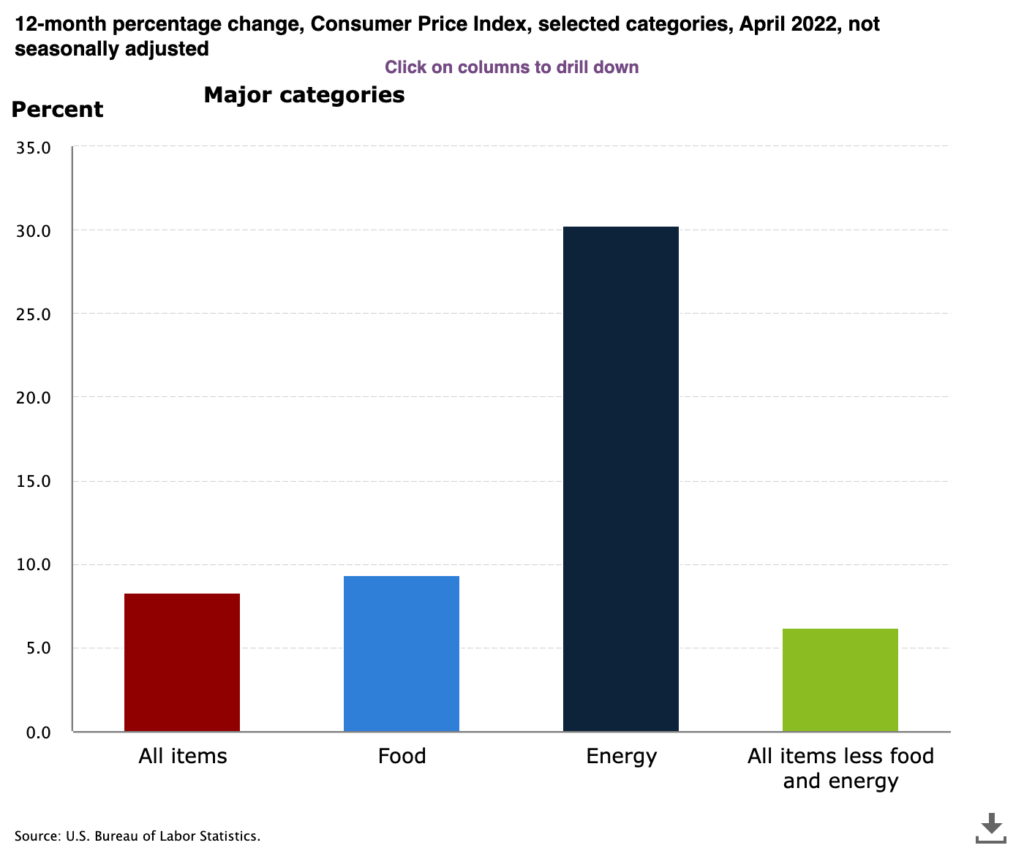

The inflationary print we saw for the month was yet again driven by gas prices, which eased in the month, but are now reaching all time highs again. In addition to rising fuel costs, the labor department reported increases in shelter, food, airline fares, and new vehicles (shocker, I know) were the largest contributors to this month’s print. With slowing down energy costs, costs for services are soaring MoM.

While energy, services, and food will likely be the purveyor of astronomic inflation, I think it’s safe to say that the inflation battle is likely maintained. Obviously, we’ll have to watch not only the geopolitical conflict unfold more, and we’ll also have to keep an eye out on China’s “zero-COVID” policy that they enacted a couple of weeks ago amidst rising cases. Assuming that these factors are somewhat under control, inflation will be a thing of the past. GREAT JOB FEDERAL RESERVE, YOU GUYS DID IT!

One interesting thing to look at is monthly net purchases of equities by individual investors.

One can surmise that consumer confidence is likely tied, to some degree, to how the equities markets are performing, now more than ever. With all major indexes just generously shedding QE-infused gains from 2021, it’s times like this where people are really starting to rethink they’re fiscal capabilities. Consumers will join the Fed in tightening their buying, thus driving down demand and prices. This is exactly what the Fed needed to do: create pain and suffering in the equities markets.

We’re also seeing a sharp decline in the basket of items with m/m inflation greater than 2% in the month of April.

Although the print this month was still near last month’s exorbitant showing, we are poised for the eventual decline.

Katherine Judge at CBIC echoes my sentiment that I had eluded to in the beginning of this post.

“Looking beyond April, base effects will help annual inflation continue to decelerate in the near term, but that will be limited by gas prices, which are headed higher again, and supply disruptions resulting from lockdowns in China, in combination with the tightening in the labor market and higher shelter prices.”

Which brings me to my next point, record home prices sent Americans total household debt to an absolutely insane value last year. Not only have Americans amassed record amounts of debt personally, but those who are renting homes are feeling the heat as rent has surged to absolutely astronomical values alongside rising home prices. The cherry on top at this point, is that real wages decreased for the 13th consecutive month. With that being the case, amidst a zero stimulus environment, consumers are reeling at the macro conditions right now. The Fed has remained adamant in their approach to fighting inflation via measly Fed Funds Rate hikes (better than nothing I suppose). Sentiment is low, and the consumers will absolutely let it be known.

All of this boils down to: inflation is yesterday’s problem. The worst of the prints are behind us. While this is obviously such a huge cop-out (I simply do not care, economists are never right about anything, and I’m not even an economist), but assuming supply chain issues in China aren’t exacerbated, and fuel costs remained piped down, we’ll see May inflation come in around ~7.5%. Watch this actually happen, and stocks go nuclear, Not the craziest prediction, I suppose. Book it?