Asset Class Catastrophe

Inflation defeats cash, so buy stocks. Stocks are losing so buy bonds? Bonds are down so buy crypto? Well, crypto is decentralized and unregulated. It is the future, as they say, and recent global issues have given examples of crypto’s use. Just when you think you’ve figured it out and found the right one, they rug pull you.

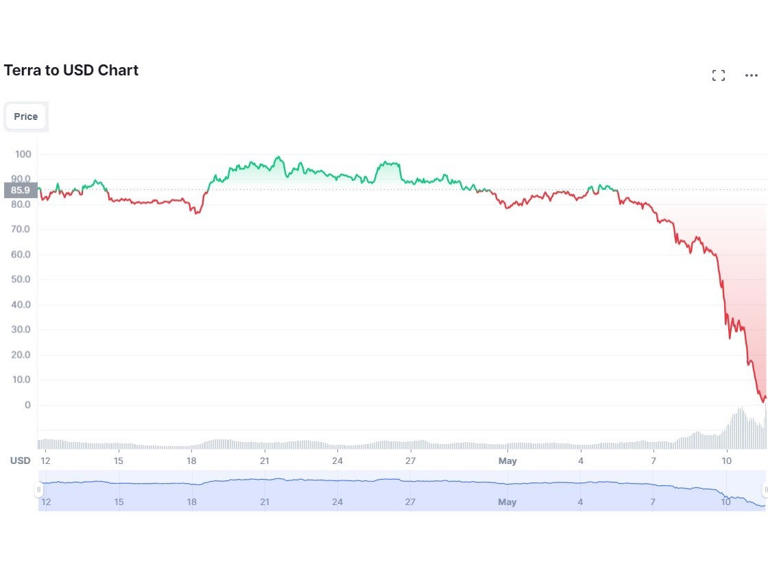

On Wednesday, Terra (LUNA) fell by more than 99 percent. Crypto investors were wiped out instantly. Terra is one of the top 10 currencies in the crypto world and fell below $1. Comments flooded Reddit with investors losing their savings and on the brink of losing their minds. Binance temporarily suspended withdrawals as high volume requests from paper hand investors clogged their servers. LUNA has lost about $10 billion or more in the past 48 hours. On Thursday, the currency is nearing $0 in value.

The collapse comes after large outflows of the project Anchor, home to 20% yields (lol), began over the weekend. “Anchor offers market-leading yields of up to 20% on the year to users who deposit their UST on the platform. Before UST started its decline late on Saturday, Anchor was home to 75% of UST’s entire circulating supply. That’s $14 billion of UST out of a total circulating supply of $18 billion.” according to Sam Kessler & Sage D. Young over at Yahoo Finance. So without UST, you can’t have Anchor or its thick returns. Anchor, according to critics, was holding up Terra artificially so losing one leg knocks down the whole table. UST deposits declined from $14 billion to $3 billion, signaling a loss of confidence. So why is LUNA down too? Well UST is supposed to be a stable coin that ensures $1 of UST is $1 of LUNA. Like the examples above, you can’t have one without the other. So as the funds began evaporating in UST, LUNA quickly followed suit. Do Kwon, CEO of Terra (or whatever they’re called) took to Twitter to discuss a rescue plan.

In addition to this, BTC broke below $30,000 on Wednesday, wiping out the gains seen in 2020. The quick losses will likely face repercussions from the US government as the immense volatility deems it riskier than some may be lead to believe. “I wouldn’t characterize it at this scale as a real threat to financial stability, but they’re growing very rapidly,” Yellen said, during testimony at the House Financial Service Committee. No one is safe and I hope that this summary helps people somewhat understand. I’m still trying to figure it out but one thing I know is that the crypto market is taking a beating. CRO, LINK, ETH, and APE Coin are seeing new lows as asset classes catch fire. Buffet seems to be right in his belief that the dollar is the strongest currency. Thanks for reading!