PCE Print Sends Stocks Nuclear; But Economic Uncertainty Remains

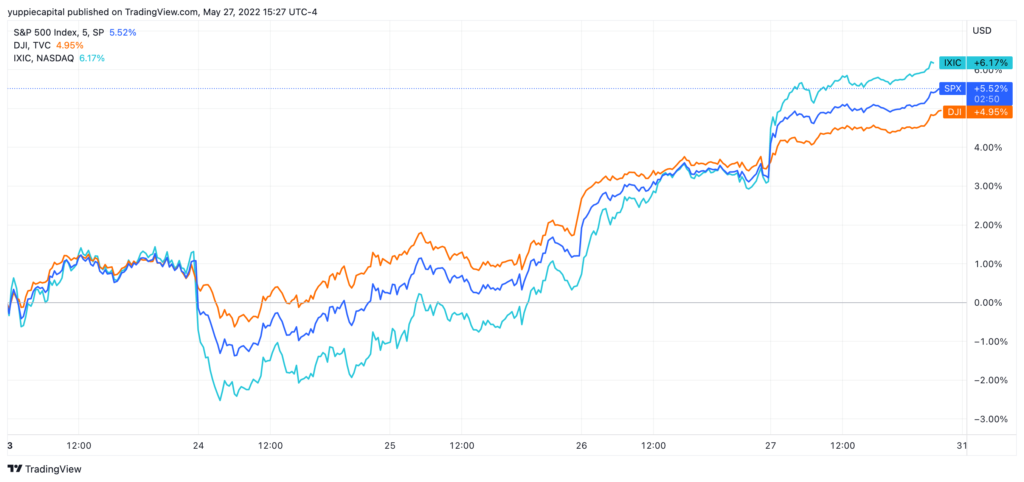

As the algos were awaiting a lower PCE print to send markets trending higher this week, PCE came in as expected, both on a MoM (0.2%) & YoY (4.9%) basis. This apparently didn’t matter and the beaten down bulls had taken the reigns and unleashed one last squeeze to close the week.

The S&P had its best week since two months ago back in March, when we squeezed out a relatively short-lived rally, which subsequently turned into a near bear market trend. In any case, major indexes are due to close the week in stunning fashion, up ~5% across the broader market.

As noted by yours truly at last month’s CPI print, we officially called the top in inflation. As it turns out, that’s where the data seems to be pointing. Core PCI (excluding food & energy) came in at 4.9%. This marks the first print below 5% in 2022. President Biden also came out with a statement earlier today and said “This morning’s decline in inflation is a sign of progress…” I guess it becomes real when the WH issues an official statement. Whether or not it’s anecdotal, I’m still using it to support my case.

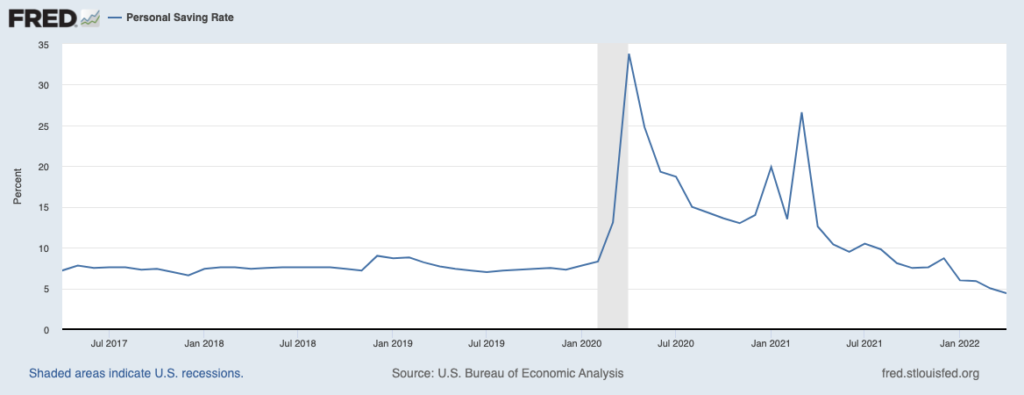

Now, a slew of god-awful earnings reports from major retailers was the harbinger to the abysmal personal savings rate that was also reported today. Currently, the personal savings rate stands at 4.4%, down from a previous estimate of 5.0%. Yikes. This also marks the lowest personal savings rate since the GFC. The American consumer never ceases to amaze me.

This almost certainly predicts that we are about to enter into a recessionary period. While we are all in favor of lowering inflation, it is a sign that we are pivoting our spending habits, which directly contribute to the health of our economy. With credit markets tightening, companies slashing guidance left and right, and consumer outlook likely to worsen throughout the year, the only option is a recession. The supply chain fiasco is not likely to get sorted out either, which certainly doesn’t help the already exhausted consumer.

Now, with economic conditions tightening (as induced by the Fed), that doesn’t necessarily mean that markets will get absolutely hammered as a result. Although the rally that we saw this week is likely short lived, we probably have more room to trend downward. However, 2022 may not bring the imminent collapse that so many dumb perma bears on Twitter are calling for. The Fed underwent a Quantitative Tightening cycle starting in November 2017, ending in September 2019. The U.S. economy grew 3.0% in 2018, and 2.2% in 2019. Markets also traded favorably during this period (up ~15%). As long as we continue to run budget deficits alongside QT (although we won’t be creating productive wealth but that’s a topic for another discussion) equities can likely find some support and trend upwards.