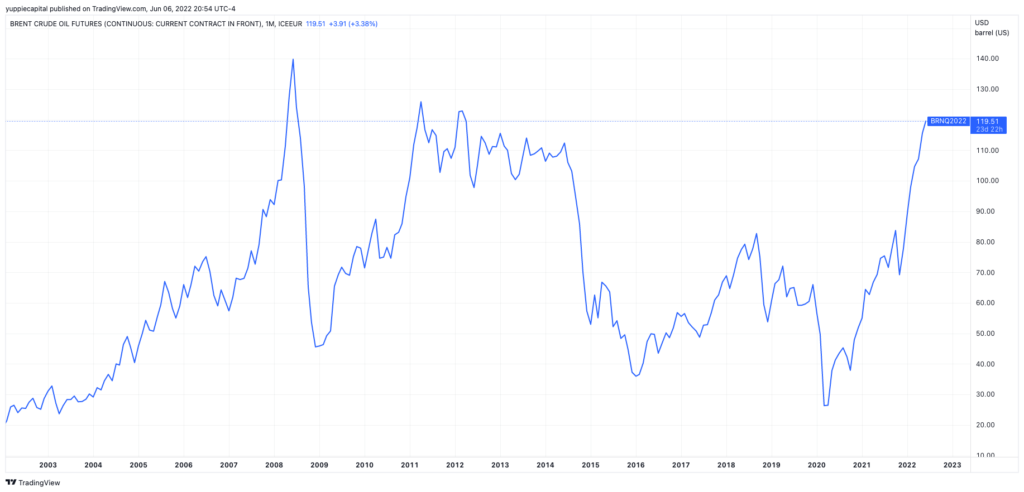

Is The Oil Market Signaling More Carnage?

The oil market is back on its bullshit again. Oil has seen a rather strong uptrend in price after massive price swings, both up and down, throughout the month of March. During the whole month of March, Brent Crude Oil Futures had multiple $30 price swings in just a matter of weeks. At the time of this article, the continuous contract is settling at just over $120.

Obviously, we’ve retreated slightly from the highs, we’ve seen steady climbs throughout the month of May, which is ostensibly ominous given the fact that we are heavily tapping into our Strategic Petroleum Reserve. Throughout the month of May, we had made a sale of 24.1 million barrels, the most on record this year. What will happen to the price when we’re not absolutely hammering the supply side of oil? One can only imagine that it’s going higher.

The dramatic spike in oil had been somewhat of an indicator when assessing the lead up to the GFC back in 2008. We had officially entered recession territory in December of 2007, with the total collapse of the major equities market not coming until around September of 2008, with the sell-off lasting well into March of the next year. The oil market went on an absolute tear throughout the summer months of 2008, before collapsing dramatically. The economy shortly followed suit.

This comes amidst a prescribed portentous outlook for the American economy. GDP shrank in the first quarter of 2022, numerous companies (namely tech) are announcing layoffs by the boat loads, and even the likes of Cardi B who has been presumably watching Bloomberg has joined the economic conversation, positing to her Twitter followers when the government will announce that we’re actually in a recession. Rare Cardi B W.

And most Americans apparently share the same economic sentiment as Ms. Bodak Yellow. A survey conducted by the WSJ claims that ~83% of respondents out of 1,071 adults taken between May 9-17 have described the economy as “Poor or not so good.” This comes at a time when the price of gas had somewhat relaxed from its March highs, but is now seemingly on an unstoppable rise yet again. I wonder what story that poll would tell this time. Although the labor market is arguably a lagging indicator, it is pretty much the only piece of economic data that supports the bull thesis (although I think it is only a matter of time before the labor market absolutely implodes).

Although unofficial, it’s time to go full Ray Dalio and start expecting for the “beautiful deleveraging.” Although I can say with confidence that this deleveraging will be just about everything but beautiful. BOOK IT (unfortunately).