CPI (Continued Price Increase)

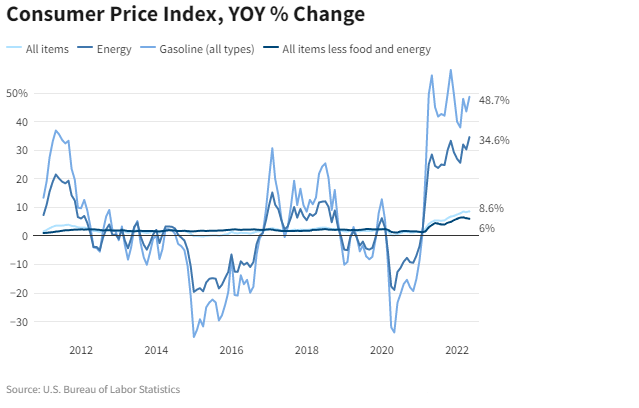

On Friday morning, the CPI was reported at a 40-year high, surpassing the last reading of 8.3%. The mark hit 8.6%, the highest since 1981. As usual, the rise was fueled by a surge in energy costs with gas, oil, and utilities, climbing 3.9% in May. Alongside fuel, the cost of food accelerated to 10.1% year-over-year, the highest rate since March of 1981. Shelter costs were up as well, coming in 5.5% higher. The continued rise of prices across the country entails that the Federal Reserve’s already “aggressive” approach isn’t as aggressive as they may have hoped. These numbers will likely push the Fed to be even more aggressive and the market likely believes that to be true with the S&P and Nasdaq returning all of their gains for the week by Friday morning.

In light of it all, the Consumer Sentiment Index showed confidence falling to a record low in June. According to Investopedia, “The index reading of 50.2 marked the most pessimistic result since the survey began in 1952, surpassing the previous record low set in early 1980 when inflation hit a postwar high of 14.6%.” Lord help us if inflation gets above 10%. Other items that have seen sharply higher prices over the last year, according to the May inflation data, include:

- Fuel oil — 106.7%

- Gasoline — 48.7%

- Eggs — 32.2%

- Natural gas — 30.2%

- Used cars/trucks — 16.1%

- Airfare — 12.6%

- Fruit/vegetables — 8.2%

It seems that no one is going to be immune to the rise in prices across the nation and the bottom half of income classes will face the brunt of the increase with almost 40% of their costs being fuel. With an even more aggressive tightening approach on the way, the market will likely continue its slow trend down until the Federal Reserve cuts rates. In last week’s newsletter I was hopeful on a run to 420 but instead got a nice grind against the 417 high throughout the week. The market currently sits at about 390 and will either fade and retest the 380 lows or sit around here as options expire this week, June 17th. I’d say cash is king at this point, to an extent, as almost every asset class is beginning to feel the pressures of interest rate increases with home demand plummeting, the used car market fading, and now private equity is beginning to mark down their valuations. Thanks for reading, and as always, make sure to follow @glizzyoptions and @yuppiecapital on Twitter for more.