CEO’s Fear Looming Recession

In the latest report published by The Conference Board, more than 60% of CEO’s that were surveyed believe that a recession will take place within their geographic region within the next 12 to 18 months. 15% of respondents believe that their region is already in a recession. For reference, in late 2021, just 22% of CEO’s surveyed by The Conference Board thought there was a risk of recession.

Ahhhhhh, the era of easy monetary policy is officially ending, and ostensible tough times await! To be completely honest, I don’t know how this number of CEO’s isn’t higher. Although, maybe the remaining respondents who didn’t have a firm believe in a presumable recession just have more macro insight than the rest of us. Who knows.

But in any case, economic conditions WILL definitively be harder for businesses to operate. The Federal Reserve announced on Wednesday that they would be raising the Fed Funds Rate by 75bps, as opposed to the original 50bps that was thought to be the case coming from the last FOMC meeting. Stocks had a very bizarre reaction on the news, and then just decided to absolutely hemorrhage during Thursday’s trading session. Yields on Treasuries were also up as a result of the news. All of these markets make quite literally no sense.

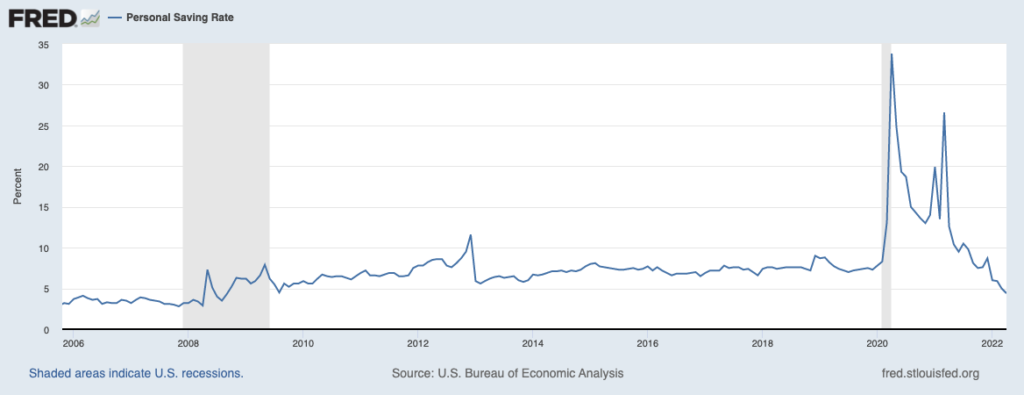

Not only are businesses going to have to operate under tighter monetary policies enacted by the Fed, but margins are still very much at risk. Inflation has absolutely soared to astronomical highs, as last Friday’s CPI print took the world by storm, coming in at a heinous 8.6%. Businesses will most likely be passing down rising costs onto consumers, but that works only under the premise that the consumer will be able to withstand a litany of rising prices across the board. Americans are already paying more at the pump, at the grocery store, and in virtually every other aspect of their lives. The only deflationary aspect of Americans’ lives is their asset prices that they’re holding, as the S&P 500 officially entered into a bear market earlier this week. The personal savings rate also recently fell to levels not seen since the GFC…

Tech companies who were fairly ill-prepared for the deteriorating economic outlook have already started to send some of their employees packing, as Wall Skreet touched on weeks ago. Since that post, Coinbase, Redfin, and even Tesla have made announcements to cut staff in the very near term. The high and mighty unemployment number (that the Fed holds very near and dear to their heart) is still within a relatively healthy range (although labor force participation amongst other factors subject the validity of that value).

I think what we really need to pay attention or what the big Wall Street names are saying, right? How could anybody forget when Bill Ackman went on CNBC before pandemic pandemonium and warned the American public that “hell was coming” while simultaneously strapped to the gd teeth in short positions? And now we have Jamie Dimon who is trying to stir the public again, claiming that a “hurricane is right out there down the road coming our way.” NICE. Will we go 2/2 for big deck (shoutout Liquidity) Wall Street titans moving the markets and predicting the future? It seems likely. Book it.