The Precarious U.S. Economy

With a litany of sell-offs in stocks, record high CPI prints, and continuous tightening of interest rates, practically all the discourse surrounding the mainstream financial media has been focused on the impending recession (or technical recession that we are presumably in) that the U.S. economy will/is facing. Virtually every indicator (with the exception of a few) paint a portentous picture for the near-term U.S. economy.

Let’s start with the leading indicators.

The first leading indicator are bond yields. Specifically, the 2YR and the 10YR yield curves. Back towards the end of March, the 2YR rate topped the 10YR yield for the first time since 2019. This is supposed to be a fairly indicative signal that points to a recession at some point in the future. As a result of yield curves inverting, “there has been a better than two-thirds chance of a recession at some point in the next year and a greater than 98% chance of a recession at some point in the next two years,” according to Bespoke.

Now, obviously exogenous forces were in play back in 2020 in the onset of the COVID induced lockdowns which sent the global economy to an absolute grinding halt. GENERATIONAL BUYING OPPORTUNITY THOUGH.

Another leading indicator is housing starts. As we know, the housing market has been cooler than a bitch (shoutout WUNNA) throughout this year. Mortgage rates have been doing quite literally nothing but going straight tf up, and housing starts showing a fairly steep decline in the month of May is very much indicative of that.

Builders appear to be fairly cautious of the economic headwinds that exist up ahead. Much of the slowdown in housing starts throughout 2021 can be attributed to the absolutely nuclear price action of many raw materials that are used in the construction of new homes (everybody remembers the most immaculate bull run that lumber went on in 2021). In any case, there appears to be a general lack of appetite amongst home builders, given the fact that there is likely not much incentive to enter the market at this moment in time. Let’s check in on the 30YR fixed rate.

Yup, that adds up.

Let’s move to lagging indicators.

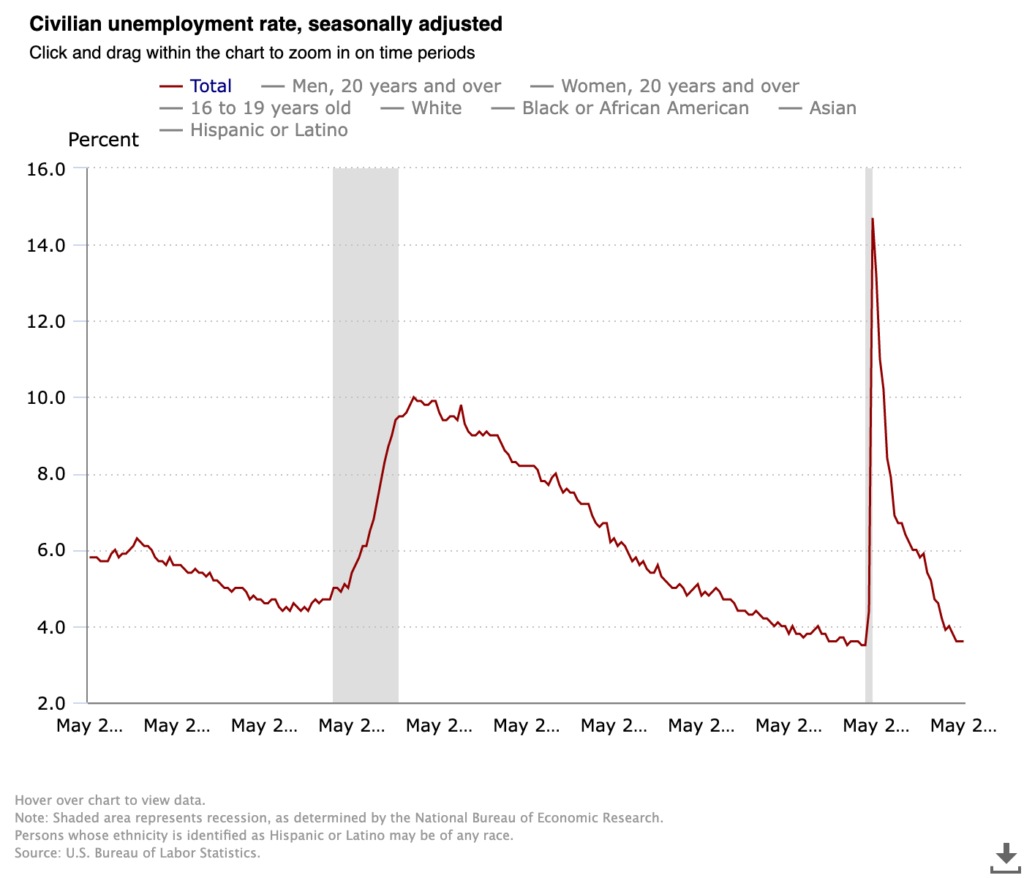

The employment picture is a helpful lagging indicator. After the onset of the pandemic, the unemployment rate throughout the country has improved significantly, falling to a current 3.6% in May, down from a high of 14.7% in April 2020. The 3.6% we’ve seen has remained constant over the past three months, after steady declines throughout the past two years. Historically, this is a rather strong unemployment rate, where the Fed tries to maintain the rate at around 5-5.2%, although the Fed is also determined to maintain homeostasis within unemployment and inflation, seeing as how “price stability” is a variable that they’re interested in maintaining. We’ll just pretend they didn’t inject trillions of dollars into the financial system over the past two years…

While it’s hard to determine what the future of the employment situation is, it’s important to note that we’ve already seen layoffs occurring, specifically within the tech sector. This, coupled with a rather constant unemployment rate suggests that the macroeconomic conditions will continue to deteriorate throughout the remaining part of this year.

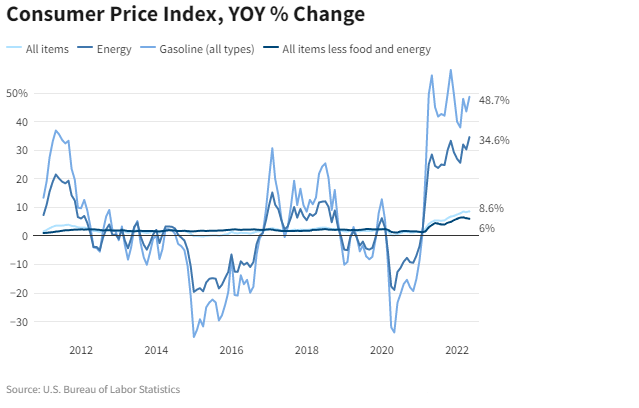

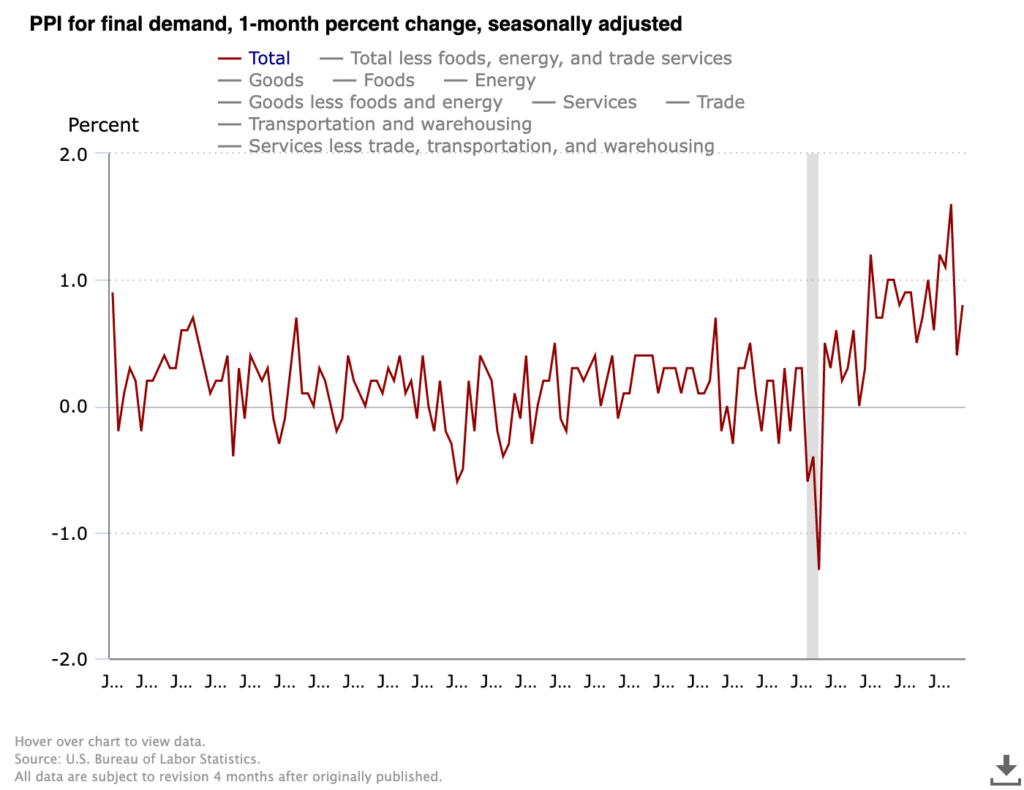

Another crippling lagging indicator is the Consumer Price Index (CPI). I really don’t need to get much into this because we all know that CPI prints have continued to just run absolutely nuclear. Not only has CPI prints continued to run hot, but PPI (Producer Price Index) numbers have also trended the same, not giving up any gains pretty much since the onset of the pandemic. This plays to the notion that the higher prices instituted by producers will ultimately fall unto the consumer eventually, thus continuing to drive the inflation numbers up.

And finally, we’ve seen the equities markets absolutely bleed throughout this year.

The risk-off trade has been very much realized at this point. Massive sell-offs in all major indexes are also coupled with sell-offs in other highly speculative assets (ie cryptos). The algos have seemingly digested all of the macroeconomic data available to them, coupled with the new monetary policy that the Fed has been and will be implementing in the future. It’s obvious that we’re in for some degree of pain throughout the remainder of this year, and likely throughout 2023 as well. The ultimate question is, how long until the Federal Reserve decides to pivot and “save the day”?