BoJ Owns Over 50% of Japanese Bonds

And just when you thought the Federal Reserve engaged in the most unparalleled government debt buying frenzy, the BoJ quite literally said “hold my beer.” Just three years ago, the BoJ had already amassed the title of top ten bond shareholder in 50% of Japanese companies. You honestly have to just respect the level of gross negligence there.

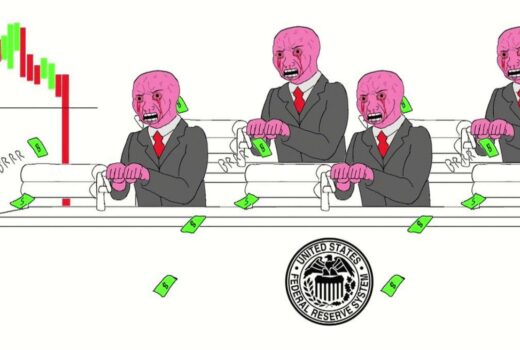

And as of June 27th, the BoJ has officially assumed ownership of over 50% of the JGB market. It’s hard to imagine a more loose monetary policy journey than the Fed and the U.S. Treasury. Also, the U.S. Treasury shouldn’t even be called the U.S. Treasury at this point. It should be the U.S. debtee or lienholder or some shit. We don’t even have a budget to manage any more. It’s just a “debt ceiling”, or like a semipermeable membrane which basically lets anything pass through. Anyways, the BoJ made history, and that’s seemingly all that matters.

In a frantic monetary environment where virtually every other central banking syndicate feels the need to begin tightening monetary policy, the BoJ is seemingly unwilling to do the same. For reference, the Federal Reserve’s highest ownership of U.S. Treasury debt was at the 20% level back in March 2022. The Fed has began their tightening policy this month in hopes of slowing down the economy, ultimately hoping for a “soft landing.” The ECB ownership of Euro Bonds totaled ~30%, and they are set to tighten beginning next month.

The reckless abandon nature of the BoJ has left the Japanese Yen struggling, and quite literally crying for help. The Japanese Yen has fallen to a 24-year low against the U.S. Dollar, which has subsequently facilitated its nuclear bounce upwards. The DXY is currently trading just below a 20-year high.

According to Nikke Asia, “Japan’s top three banks hold a total of over 70 trillion yen in JGBs. The average maturity is 2.8 years for Mitsubishi UFJ Financial Group, 2.8 years for Sumitomo Mitsui Financial Group and 1.2 years for Mizuho Financial Group.”

Interest rates will inevitably rise in the near term, at least that’s what the major players are assuming will be the case. It’s clear that the Japanese government needs to compliment the most egregious monetary policy in the universe. As I would say, “if you’re on thin ice, you might as well dance.”