What The Hell is Going On?

“Nobody…I don’t care if you’re Warren Buffett or Jimmy Buffett, nobody knows if the stock is gonna go up, down, sideways, or in fucking circles.” Carnage ensued in the markets on Wednesday, when the BLS reported a hot boi of a CPI print, coming in at 9.1% YoY. THE BLOCK IS HOT LIKE A SAUNA. The S&P made an immaculate comeback intra-day on Wednesday, finishing the day down ever so slightly. Bonds per usual got hammered, and oddly enough, oil is fighting for its life (probably a good thing for the consumer, but historically this does not bode well).

The U.S. economy finds itself in a very unusual state. Consumer confidence is at all time lows, The U.S. Dollar remains at historically strong, (contrary to the levels seen in the GFC), and unemployment is still strikingly low (although we’ll get into this later). Bond and equity markets also haven’t done the slightest bit of decoupling, where government debt has historically served as the preferred risk-off asset, much of what you would inspect investors to flood in an environment like the one we’re seeing today. It may be safe to assume that the Fed absolutely dismantled the system with years of QE and ZIRP, but honestly who knows?

In any case, Jamie Dimon’s J.P. Morgan got absolutely smoked Thursday, when their Q2 2022 profit fell 28% from just a year before. Banks have seemingly nowhere else to go as the financial system is akin to the Sahara Desert where liquidity is drying up portentously. But as Jamie Dimon so eloquently puts it, “…it could be a soft landing, or it could be a hard landing. You do not have a serious set of issues out there.” Maybe it doesn’t appear that we do on the surface, but let’s look into where we may be going.

As we’ve discussed previously, employment tends to be a lagging indicator. One could surmise that a “strong” labor market right now means things must be going swimmingly, right? There is evidently much more pain to be seen within the labor market, with much of the initial rush of layoffs coming from big tech (shocker, I know). So far this year, 143 tech companies have laid off a total of 24,000 employees this year. A multitude of other tech companies have announced either layoffs or hiring freezes, most notably Apple, Uber, Lyft, Snap, Hopin and Coinbase.

Inflation continues to burn holes through our savings, and it doesn’t appear to be residing any time soon. The BLS Reported Thursday that the Producer Price Index (PPI) was up 11.3% YoY in the month of June. The PPI serves as forward looking to CPI, so one can imagine that we may not see the worst of inflation as of yet. Not only does this hurt consumers, but this hurts businesses as well. They will have to cut costs somehow, and the last paragraph is just one method of doing so.

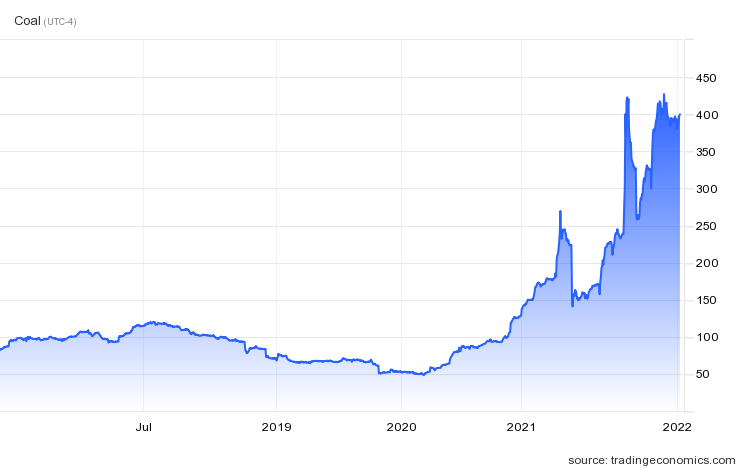

It’s also worth noting that coal is making an absolute resurgence, with countries (most notably Germany) shifting the blame on Russia for their increased dependence on the dirtiest fossil fuel on the planet. If only we could find a way to put our brilliant minds together to find a way to remediate the pollutants caused by burning coal. Imagine that.

It’s quite clear that nothing really makes sense any more in the post-COVID economic world. I would honestly rather paint my entire bedroom with just a q-tip, than to try and make sense of anything that’s taking place right now.