Powell Is Pissing His Pants

The writing was absolutely on the wall here. Powell will be speaking at Jackson Hole Friday morning in what will presumably be a “hawkish” address to the American public. Can we really expect anything less at this point, though? We have enjoyed irrational exuberance in pretty much the entirety of 2021, with an absolute onslaught of Federal Reserve induced euphoria in ZIRP + QE; which turned out to be nothing short of a party back (shoutout ESCO). But what goes up, must come down, right? This is exactly where the Federal Reserve, namely Jerome Powell, finds itself coming into Jackson Hole.

While we have arguably reached “peak inflation” at this point, the central banking syndicate still needs to inflict more pain on virtually all asset classes in order to give the American consumer some much needed reprieve. But his counterpart in governance (Joe Byron) certainly isn’t making things any easier for him. Albeit tiny raises in EFFR, Powell is urging everyone to just chill for a hot sec with the spending. Meanwhile, Biden is going full Leeroy Jenkins and telling Biden to take 6 steps back, and literally fuck his own face. I love the harsh dichotomy that exists behind the scene between Biden and Powell. I think Joe must’ve forgotten the memo that was likely relayed to him when the two met back in May.

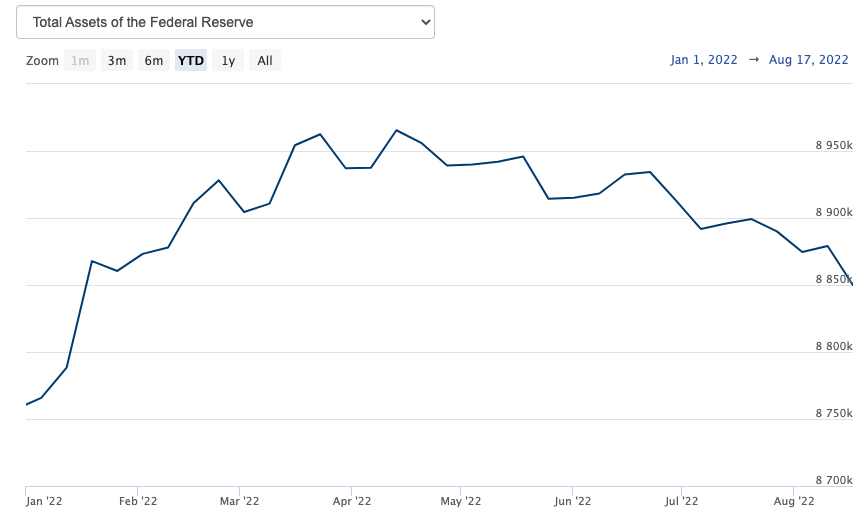

The Fed hasn’t lost total control at this point. Federal Reserve Open Market Operations appear to show the Fed reversing course and removing capital from the financial system. Total assets held by the Fed in April 2022 nearly reached $9 Trillion, whereas now they have shrunk to ~$8.85 Trillion. NICELY DONE EVERYONE.

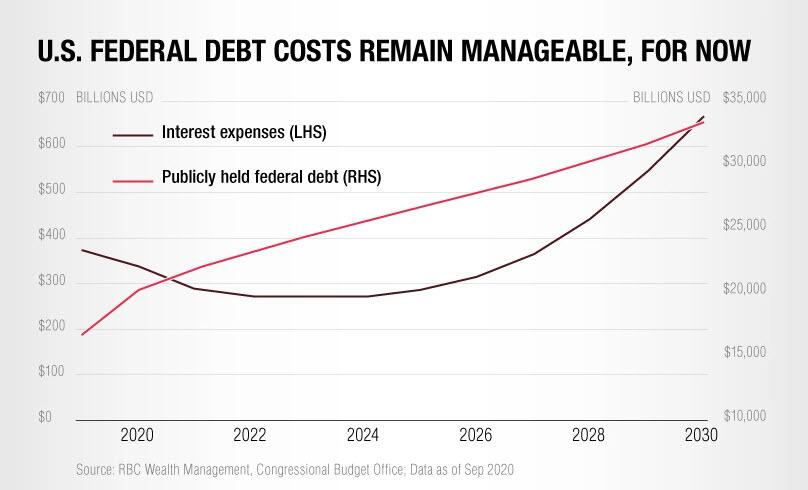

For now, everything seems to be at bay. However, we are likely to reach an inflection point that isn’t necessarily captured by the chart shown below. Debt servicing has been manageable for the time being because of exponentially low interest rates. QE + ZIRP was fine, but the inflation narrative has stirred up the general public, forcing the Fed to utilize its (only) tool and raise the EFFR to stifle growth.

Raising rate environments are not to be coupled with exacerbated government spending, though. Debt can very easily spiral out of control at a time when central banks need to keep the financial situation from going awry. This will ultimately force the government to allocate more of its monies to servicing debt, and less towards spending, ultimately stifling growth. What does that mean? ENTER FULL ON RECESSION, BABY.