MetaStreet Is The New Fannie Mae

Asking everyone to take their bets here. Blockworks reported an $8 million loan backed entirely…by a user’s Cryptopunks collection. Does this usher in the official top?

According to Blockworks, “The loan has an APR of 10% and a 30-day duration. It was facilitated by liquidity scaling solution MetaStreet on peer-to-peer lending platform NFTfi.” Personally, It’s times when people get absolutely levered up that I live for. I love seeing individuals just taking obscene amounts of risk with zero remorse.

In his interview with Blockworks, Conor Moore, the co-founder of MetaStreet (the loan originator), came out with arguably the most irony ridden claim ever in existence. He told Blockworks, “By having an active borrowing and lending market [in NFTs], you create productive assets that are otherwise viewed as unproductive…”

Not to let my bearish crypto sentiment come off too strong, but this has to be the most outrageous statement ever made. What value/productivity do NFT’s inherently provide/enhance? What happens when the world wakes up one day and collectively decides that the algorithm-produced grouping of pixels is worth close to nothing? Not to go completely Jeremy Grantham in this blog post, but this is arguably one of the most outlandish statement ever conceived.

Moore even went as far as to claim the grouping of NFT backed loans is comparable to how Frannie Mae works within the U.S. housing market. He’s not completely wrong, but I can’t exactly draw the same terminal value of a home, to that of a screenshot.

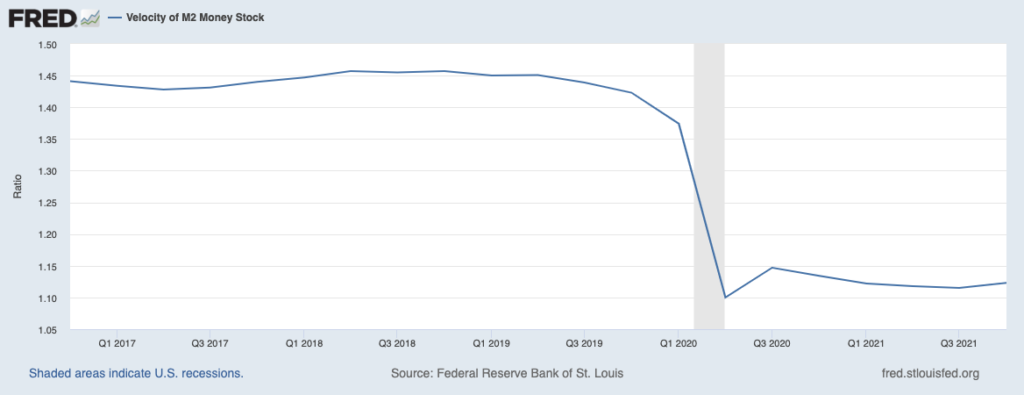

The CEO of MetaStreet, David Choi, wants to give moneys tied up in NFT’s carte blanche to run amok in the financial system, so that they do not collect”virtual dust.”

Choi is pointing to this graph, claiming, “We need to pump these up, these are rookie numbers.”