Student Loan Forbearance Paints Portentous Picture

The NY Fed released on Tuesday a snapshot of the current student loan situation, which is incredibly ugly to say the least. In the onset of the COVID-19 pandemic, legislative action provided relief to student loan borrowers by allowing them to defer payments on their student loans, while also lowering interest rates on Direct federal student loans to zero. According to the Fed, ~37 million borrowers haven’t been required to make payments on their student loans…for nearly two years. As a result, it’s estimated that a total of nearly $200 Billion will have been waived through April 2022.

While those who obtained their loans via direct federal lending were granted this forbearance, those who secured theirs via private means, were not. The NY Fed is reported that a certain group of private held student loan (Commercially held FFEL Loans) experience 33% higher delinquency on their non-student, non-mortgage debt after exiting their limited time in forbearance. As a result, NY Fed analysts conclude that “Direct borrowers are likely to experience a meaningful rise in delinquencies, both for student loans and for other debt, once forbearance ends.”

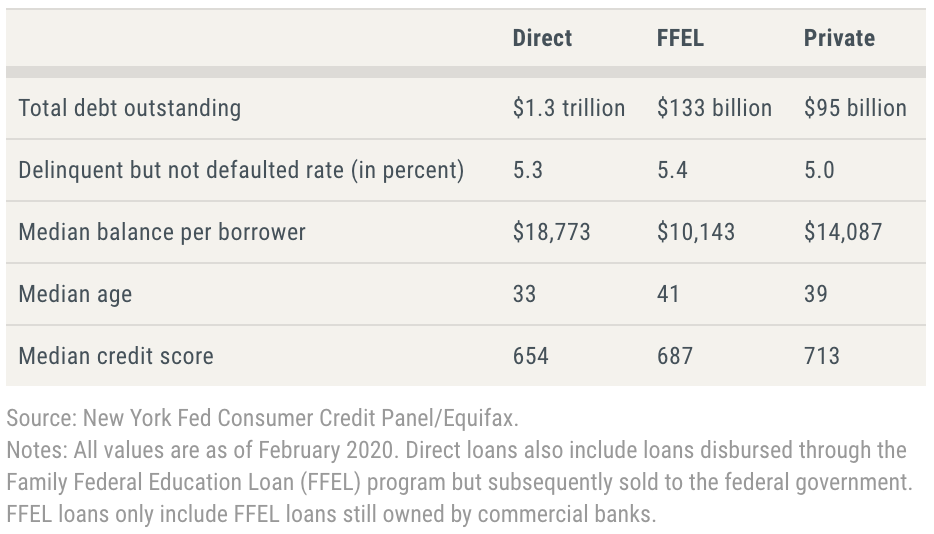

Now the group the NY Fed is currently referencing above (Direct) holds $1.3 Trillion (85% of outstanding balances).

This group have lower credit scores, and astronomically higher loan balances than the other two categorized groups. Now i’m no economic analyst or underwriter, but one can draw a meaningful conclusion that we are on the precipice of a full blown student loan crisis. Imagine a default of $1 Trillion. That’s fine though, that’s just another trillion to the total $30 Trillion in government debt. Let’s keep the gravy train running, baby.

To be quite honest, colleges and universities across the country have been able to engage in the most nefarious and counterproductive activity. The cost of college has increased 169% since 1980, and wages haven’t been able to keep up. Some have outspokenly stated that we are reaching the end of this boom cycle for colleges, and personally I’d tend to agree. The truth is slowly, but surely unraveling. And maybe this full-blown student debt crisis will be the straw that breaks the camels back.