Markets RIP Across The Board

Thursday’s trading day was a breath of fresh air. It’s always great to get a fresh rip in while the whole world turns upside down, the housing market fights for its life, and the American economy is ostensibly crumbling. Major indexes were up on Thursday’s trading day, the S&P up nearly 1.5%, the DOW up 1%, and the NASDAQ up almost 2%. Once crypto critics, now turned crypto standem, we rejoiced in Bitcoin’s 2% pop today.

Although remaining flat virtually all this week, stocks have regained some luster after absolutely hemmoraghing since the beginning of 2022, officially entering into correction territory in early March.

Real rates continue to move higher, with the 30Y mortgage rate settling at 4.16%, which is quite high relative to today’s terms.

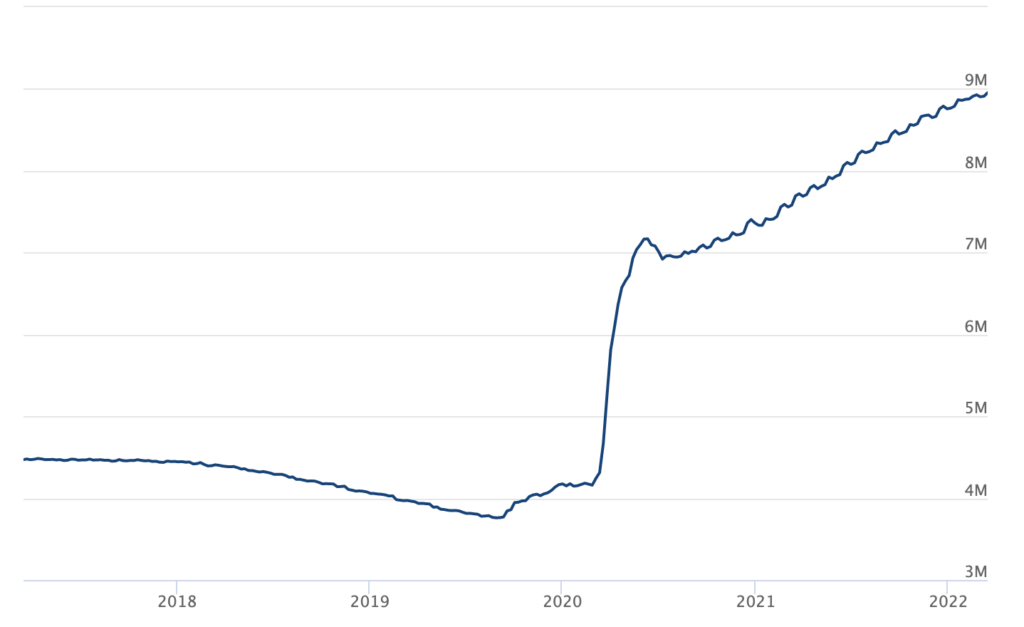

While it’s been very clear that equities markets have struggled since the beginning of the year, we can’t forget the most immaculate bull run that has ever existed in the history of the world. Just this past Sunday (March 20th) marked the two year anniversary from the COVID lows in the markets. Since then, major indexes alone have gained nearly 100% on the back of the most obscene liquidity injection into the financial system that the world will ever see. Nobody does it better than our central bank, ladies and gentlemen.

AND THE FED IS TALKING ABOUT TIGHTENING?! TIGHTENING?! IN THIS ECONOMY?!

I don’t even want to hear it. I just want to get back the the regularly scheduled bull markets that we’ve been used to for the past two years. We’ve basically never lived in a bear market and that is just insane to think about. To be quite honest, I hope the day never comes. Bull market in perpetuity. BOOK IT BABY.