SPAC Szn Is Nearly Over

The SEC reported today that they would consider levying new requirements upon Special Purpose Acquisition Groups (SPACs) to “…enhance disclosure and investor protection…”

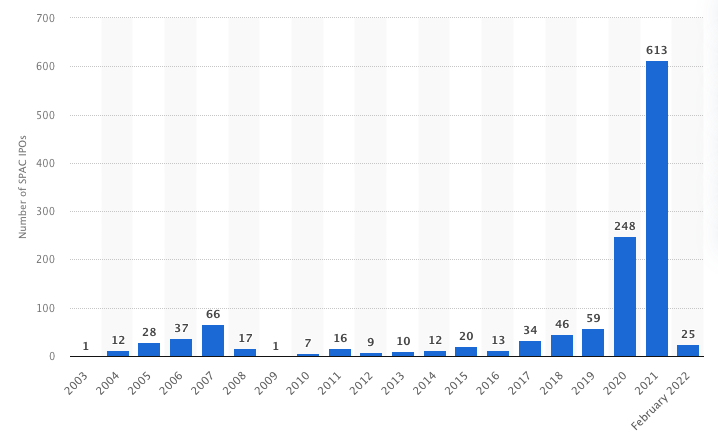

Gary Gensler (the new chairman for the SEC), wants to see the same regulations and requirements that apply to traditional IPO’s, be applied to the special purpose companies which went absolutely nuclear in 2021, as is outlined below:

Specifically, Gensler referred to three “buckets of tools” that the SEC has over traditional IPO’s, “disclosure; standards for marketing practices; and gatekeeper and issuer obligations.” The most strenuous adherence to these new SPAC requirements would be regarding “…projections made by SPACs and their target companies…” Gone are the days of wild intrinsic value projections by companies with ostensibly zero value. Which brings me back to the time when the Lucid Motors sold 39% of his vested equity to invest in a Turkey hunting farm in Tennessee. GOAT.

Just from the data we’ve seen so far this year, SPAC mergers are apt to take a steep decline from their massive explosion last year. Investors have been caught holding the bag as many of these companies have seen massive declines in their share prices amidst missed projections and generally bad metrics. Under these proposed guidelines, officials/directors within the newly formed SPAC merger would face liability for any omissions of information that would be deemed costly for investors. And of course I’m using the term “investor” very loosely here, because you’re more or less gambling when you’re taking on a huge position within one of these companies (just my two cents).

Gensler is clearly out for blood, and this could be the final nail in the coffin for companies looking for a smooth and seamless ride into the world of public markets. Although I must say it was fun to watch this all unfold in 2021. It was arguably the craziest year in the equities markets, maybe ever. ‘Till next time, I suppose.