Power To The People, For Now

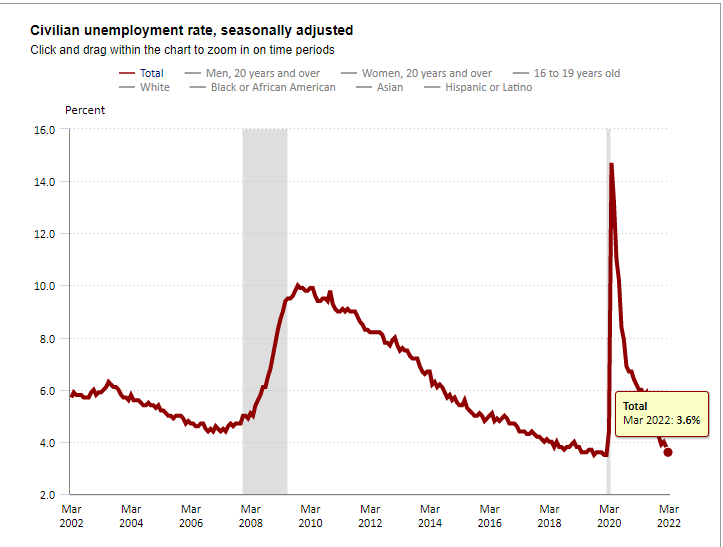

I was going to start off with an unemployment joke for April fools day but they don’t work. I think it might work this time after today’s report. For the month of March, the unemployment rate fell to 3.6% for the month, down from 3.8% in February. Jobs can’t be filled quickly enough and employers are trying to hold onto their workers as best they can. In my recent post, I mentioned that the power was in the laborers for the first time in a while with the demand being so high, they have the ability to leverage their benefits and pay and the urgency companies are feeling to keep their workers continues to show that. Apple is a great example with their recent rewards to some engineers with up to $200,000 in stock bonuses. “Apple is keen to ensure that its engineers stay put rather than move to companies like Facebook, Google, and many more.” (Haslam) In addition to the bonuses, the usual requirements for workers like college degrees, internships, their first child, and ad space on their tombstone are being overlooked as “Companies…are starting to drop these requirements…entering into the fray to find the same worker that other companies may have trouble hiring,” according to Ron Hetrick, the senior economist at Emsi Burning Glass.

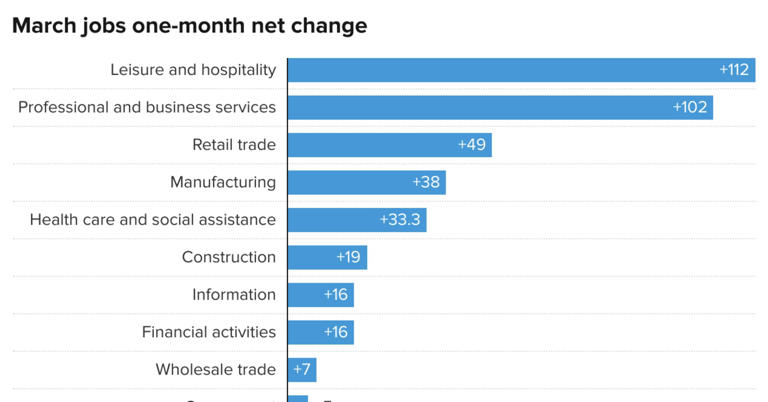

The country has added an average of 562,000 jobs per month in 2022. At this rate, the economy will recover all losses from the pandemic by June. Janet Yellen tweeted this morning “We’re experiencing the fastest labor market recovery in more than a generation, adding nearly 8M jobs since @POTUS took office—which comprises 93% of jobs lost during the pandemic. With participation rising & under-employment falling, labor market outlook continues to be strong.” Parallel with the rise in jobs, wages have increased 5.6% from February 2021 to 2022. Americans should be delighted with the opportunity and wage increases but for many, the looming fear of inflation remains. Consumer sentiment hit a bump in the road in March, hitting the lowest level since August 2011 according to the University of Michigan’s report last Friday. Richard Curtin, chief economist at the University of Michigan stated that “When asked to explain changes in their finances in their own words, more consumers mentioned reduced living standards due to rising inflation than any other time except during the two worst recessions in the past fifty years: from March 1979 to April 1981, and from May to October 2008.” Americans are bracing for the worst while some are reaping the benefits. My last post about an inverted yield curve argued that it has been an indicator for the past two recessions but the recession happened about a year later. So to those who may have the opportunity to argue for better wages and benefits, do so now before the time ends, To those who are unemployed maybe seek out a field you’ve wanted to experience, and hopefully, there is an opening, and to those who took entrepreneurship or are long TSLA, congratulations!