The Bluebird Application Is Going Electric

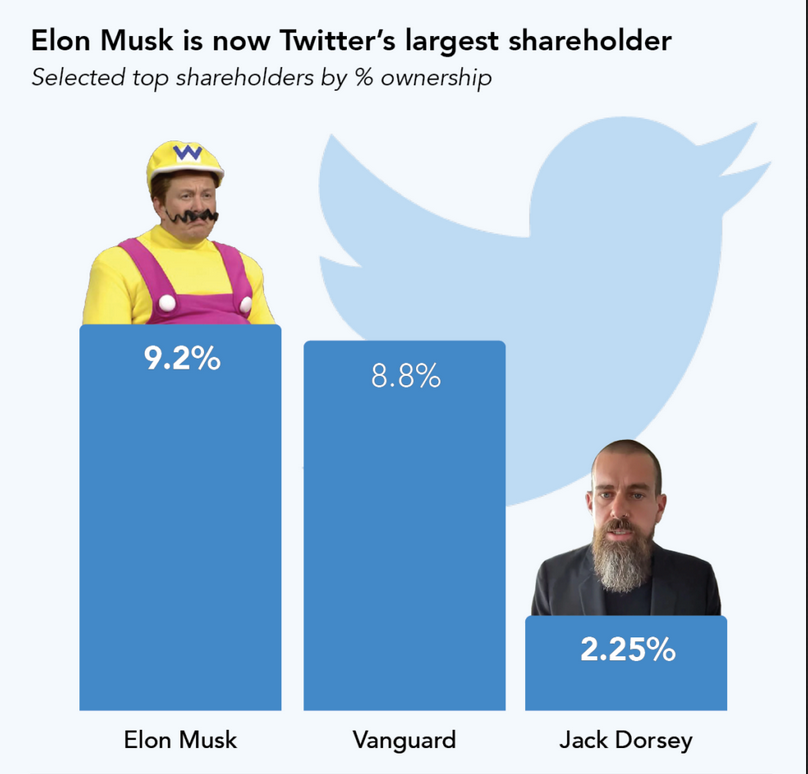

A few days late for an April fools prank but it isn’t a sick joke. Well-known Twittersphere meme lord Elon Musk, who is also the CEO of Tesla, announced on Monday morning that he has taken a 9.2% stake in the bluebird application. The stock soared 25% in early morning trading from39 dollars a share to 49 dollars a share. As comedic as it may seem, Elon Musk expressed his interest in creating his own social media platform but why build a new one when you can simply attempt to improve an existing one.

Twitter may be one of the largest social media platforms available right now with over 206 million daily active users but the issue has continuously been how the company would generate revenue. You’d think that with endless scrolling, countless opinionated threads, and breaking news (literally breaking news at your fingertips) the company would be making cash hand over fist with ad revenue and targeted ads but over the past few years, the stock reflects the poor execution. Since its IPO, the stock has remained around the initial price of $45 and since July 2021 has seen a decline from 70 dollars a share down to 30 dollars a share. Last month, the company missed analysts’ estimates on earnings, revenue, and user growth. Earnings per share were 33 cents vs 35 cents expected. The company enacted a $4 billion share buyback program. So who could’ve seen this coming?

As most of my followers know (all 295 of you that I love so much) I trade options and strongly believe options traders are some of the smartest people in the market or consistently have an edge. Twitter is a perfect example of this as 3,900 April 43 calls were purchased last Thursday into the closing minutes of the trading day. The trade-in total sums about $530,400. Taking a look at the stock and current trend it doesn’t make sense to purchase such short-dated contracts on a stock that has underperformed for the last 7-8 months. Well today, April 4th, the contracts are priced at $8.50 from the $1.26 purchasing price last week. For those who may be unaware, that is $126 dollars a contract turned into $850 a contract in less than 3 days. It is now being taken into consideration that someone may have been leaked this info but that shouldn’t matter to us because we are smaller traders, just tag along with the big guys when you can. “I find it interesting that the calls were bought in a big hurry, late in the day ahead of the end of the quarter. If I was a regulator, I would be looking into these trades,” said Steve Sosnick, chief strategist at Interactive Brokers. To sum things up the options market is always ahead it seems like a consistent flow predicts moves days, weeks, even months in advance.

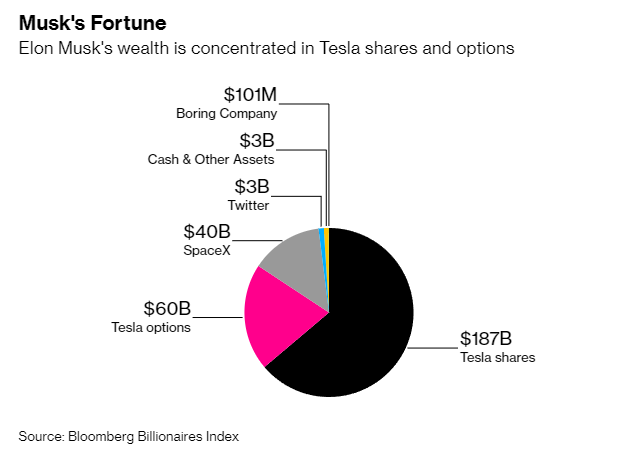

The twitter stake is a minuscule part of Musk’s wealth but he now owns the largest stake in the company. Moving forward hopefully Musk has the ability or desire to improve the company with an ambition to generate revenue. Like all social media, there are shortcomings within the app such as trolls, bots, spam, and scammers lurking within each quote tweet, and comment but with the ability to reach almost everyone in the world at the press of a button, this app has the potential to generate ad revenue consistently. We’ll just have to wait and see. The stock is currently trading around $50 with the next resistance sitting at $51.98 followed by $55.17 and $59.57. For the inexperienced options trader, just buy the shares. Save yourself the headache and play the long game in hopes it becomes one of the leading platforms.