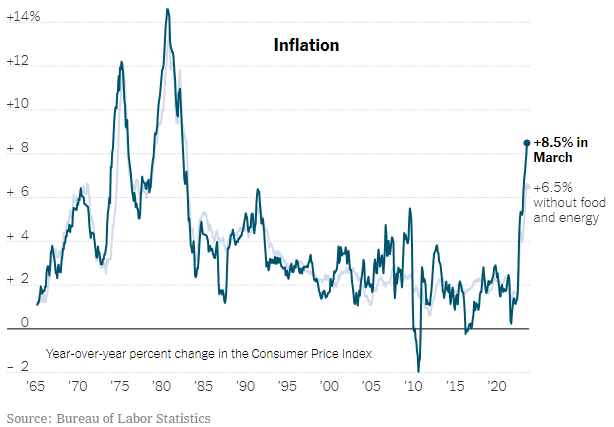

8.5% Reading for March 2022

8.5% isn’t the APR for my car loan nor the interest on my credit card. This large percentage represents the inflation recorded for the month of March, the highest on record in 40-years. Who could’ve seen this coming? Literally, anyone who pays attention to price, geopolitics, and the market. A thread: (jk)

The annual inflation rate in the US accelerated to 8.5% in March of 2022, the highest since December of 1981 from 7.9% in February and compared with market forecasts of 8.4%. Energy prices increased 32%, namely gasoline (48%) and fuel oil (70.1%) as Russia’s invasion of Ukraine pushed crude oil prices higher. Also, food prices jumped 8.8%, the most since May 1981. Also, inflation accelerated for shelter (5% vs 4.7% in February) and new vehicles (12.5% vs 12.4%) but eased for used cars and trucks (35.3% vs 41.2%). Excluding volatile energy and food categories, the CPI rose 6.5%, the most in 40 years but slightly below forecasts of 6.6%. Many analysts expect that March will mark the peak in inflation although the war in Ukraine is far from over, supply chain bottlenecks persist and consumer demand remains elevated which is likely to weigh on the CPI for longer. source: U.S. Bureau of Labor Statistics

On Wednesday, April 12th consumer prices rose 8.5%, the highest since 1981. One of the largest influences on this report is the surge in gas prices that were captured during the Russian invasion. The average price of gas hit $4.10 across the country according to AAA. High energy prices ensued higher costs for transportation which coincided with an increase in prices for consumers. As we move forward towards higher and higher prices, the Fed’s ability to put a lid on this economy through an interest rate hike is being questioned. Aside from the Russian invasion which is getting the brunt of the blame, the supply chain disruption, rapid reopening onset by covid vaccines and a decline in infections, wage increase, and strong consumer spending, the economy has never been stronger. Housing prices have continued to soar as well but a rise in mortgage rates will likely combat the home buyers’ appetite.

“For now, the economy as a whole remains solid, with unemployment near 50-year lows and job openings near record highs. Still, rocketing inflation, with its impact on Americans’ daily lives, is posing a political threat to President Joe Biden and his Democratic allies as they seek to keep control of Congress in November’s midterm elections.” (Dallas Morning News) Some economists believe that the March uptick could be a yearly high as things begin to cool down. “Despite the “very hot” overall figure, market analyst Adam Crisaffuli of Vital Knowledge Media pointed out the report also showed moderating inflation in some recently spiking categories, with the price of used cars and trucks falling 3.8% month over month after surging 35% over the past year.” (Forbes) The release of oil reserves has somewhat helped at the pump with local gas here in California dropping by almost 50 cents since the announcement. Heading into the second half of the year and with quarterly earnings for 2022 kicking off this week, it’ll be an uphill battle in both the economy and the stock market.