Tuesday’s Market Tank

What an absolute abysmal day in the markets, with the previous day’s trading session providing a presumable glimmer of hope. Elon Musk’s Twitter LBO got the nod of approval from the company’s board, and it appeared we were onto greener pastures.

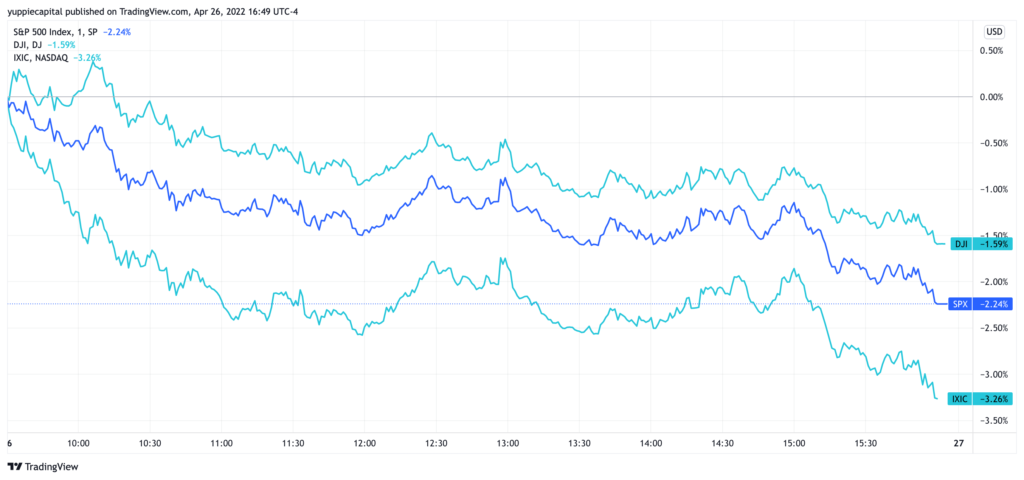

Tuesday’s trading session saw major indexes hemorrhage across the board. The Dow shed over 1.5%, the S&P was down over 2%, and the NASDAQ absolutely bled, falling over 3%.

Earnings season has seen somewhat mixed, but mostly treacherous results as investors are likely digesting the full breadth of the current state of the economy. The writing has been on the wall for quite sometime, it’s just been a slow and painful shift to the new reality. Powell spoke in an IMF panel last week, and laid the groundwork for further increasing the degree of the imminent Fed rate hikes. He alluded to a James Bullard “front loading” mode of action, where the Fed would enact 50bps rate hikes to slow things down a bit. Although I’ve said it before and I’ll say it again, a 50bps rate hike is about as useful as a poopy flavored lollipop.

In any case, the Google today joined the likes of Snapchat, Netflix, Carvana, and a litany of others who are facing the pain from the Biden Bear Market. Google posted lower sales growth than previous quarters, and fell short of net income estimates. Google traded as low as 4% after-hours as a result.

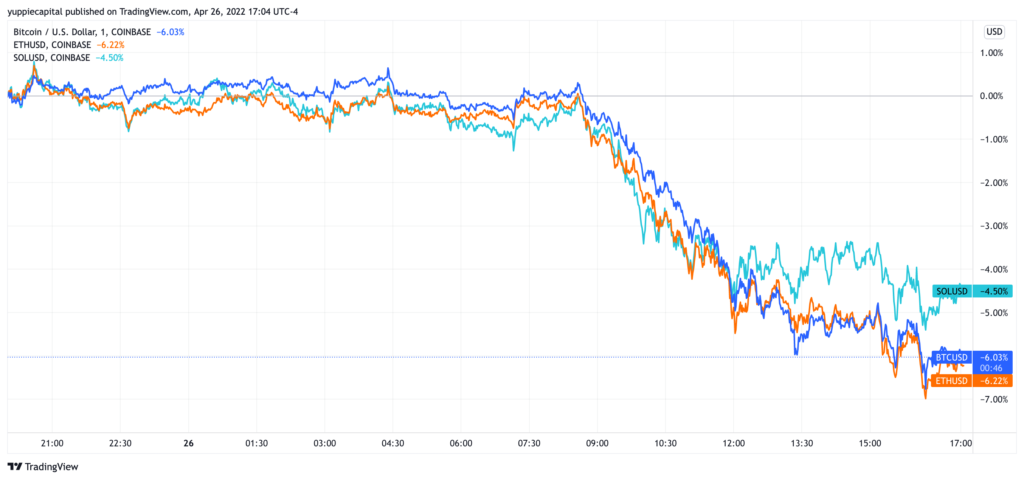

In addition to equities, the crypto market wasn’t safe from the selling frenzy that ensued Tuesday. Bitcoin and major cryptos were subject to the algos, who were very much out in full force starting around 8:30 AM ET.

It seems as though the absolute capitulation is in full force. Where are the safe havens? It seems like commodities have been somewhat of a safe haven in lieu of the Russian invasion of Ukraine. Although leveling off somewhat in the middle of April, natural gas regained losses as of recent, up over 2.5% today. Gold made modest gains in Tuesday’s trading session, but still trading somewhat below its early March high. Wheat is also obviously making headlines, as its largest exporter happens to be Russia. The price of the grain was up over 2% today, and up nearly 50% YTD alone, which is just insane.

My cereal game has been in utter jeopardy recently. What a shame.