A MasaCAR

One of the most exciting IPOs last year has seen a decline of 72% since the day it began trading. The excitement came as the company had seen investments from both AMZN and FORD. Since its release to the public, it has been nothing short of a disappointment alongside many other EV companies. The past two earnings releases have been a letdown to shareholders and the delivery numbers continue to miss expectations, forcing the company to cut projections. “Despite reporting over 83,000 reservations at the end of 2021, Rivian only produced 1,015 R1 models last year, delivering 920 according to its Q4 shareholder letter. The letter also shared that the automaker lost over $2.4 billion last quarter, explaining that supply chain woes had caused it to adjust its 2022 production goals down to 25,000.” (Electrek) From a personal standpoint, I wanted this company to work out because it is both local and sounded like a serious player in the EV game but that is sadly not the case.

The company has faced backlash throughout its short lifespan. In early March, the company decided to hike prices on preorders and new orders. This rattled the community and resulted in many cancelations from RIVN enthusiasts. Many took to the subreddit r/Rivian to share their frustration. The price hikes were short-lived and reversed almost two days later. “I have made a lot of mistakes since starting Rivian more than 12 years ago, but this one has been the most painful. I am truly sorry,” Scaringe wrote. “Trust is hard to build and easy to break. In speaking with many of you over the last two days, I fully realize and acknowledge how upset many of you felt.” (CNN) The increase in pricing was based on costs during the complexity at the time. It seems the company can’t catch a break. As the overall market continues to digest interest rate hikes, inflation, and negative GDP, you would think that RIVN stock is just following along with other companies but that may not be the case.

On Sunday afternoon, news broke that “Ford Motor is selling 8 million of its Rivian Automotive shares as the insider lockup for the stock expires on Sunday” according to CNBC. While Ford does own 102 million, the 8 million sales may not seem significant but it may be a sign of a less optimistic outlook in the short-term as the economy faces some rocky months. Ford stated that “A net loss of $3.1 billion was primarily attributable to a mark-to-market loss of $5.4 billion on the company’s investment in Rivian. Adjusted earnings before interest and taxes were $2.3 billion.”(The Street) Ford declined to comment on Rivian when asked about its sale and future decisions on its investment.

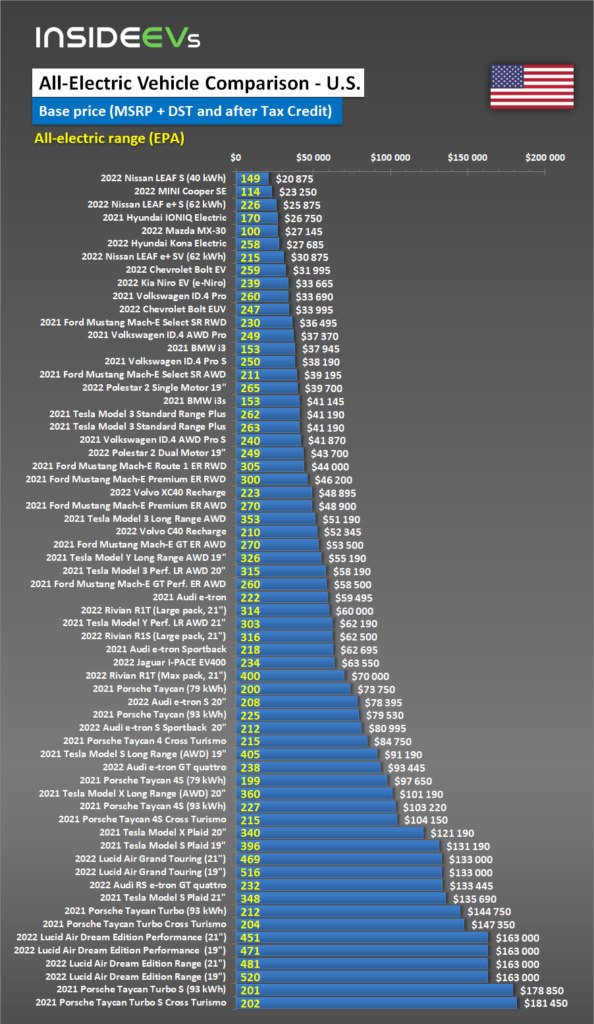

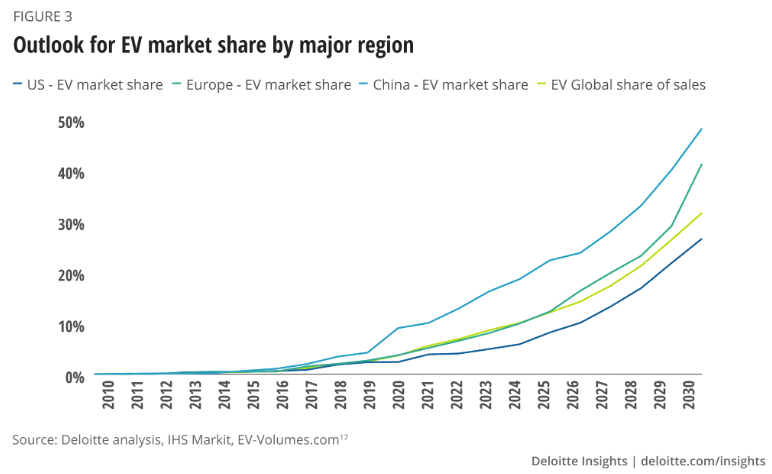

The push for change is a hot topic across the globe at the moment as gas-powered vehicles emit about 4.6 metric tons of carbon dioxide per year. As we attempt to get supply chains under control, a wave of electric and hybrid cars is being mass-produced by companies like Volkswagen, Hyundai, and Ford. Deloitte research project a strong adoption of EV vehicles by 2030. With prices varying across the board it is difficult to pinpoint the next “Tesla” which seems to be the poster-child when discussing ev. It is sad to say but there will likely not be another Tesla or a company that can compete at the level Tesla is at, at least not in the early stages. With choices like LCID (stupid), NIO (fake), FSR (idk), NKLA (lol), SOLO (lol), and RIVN all trading publicly, it is hard to decide. RIVN reports earnings this week and will likely miss but the guidance is something to pay attention to. I am somewhat biased due to the fact that the trucks are on the road everywhere I go and their delivery to Amazon has been successful. In 10 years I will either lose some money (tax loss son) or have a fierce competitor who can deliver cars to the public.