A Shellfish Act

In wake of the current war going on overseas, companies have sanctioned and disbarred any transactional relationship between themselves and Russia. A side effect of these sanctions is hitting Americans at the pump as gas prices soar to an average of $4 a gallon in the United States. Crude Oil futures hit 130 today to kick off the week and while other companies are scouring to find an alternative supplier, one company is looking to benefit from this.

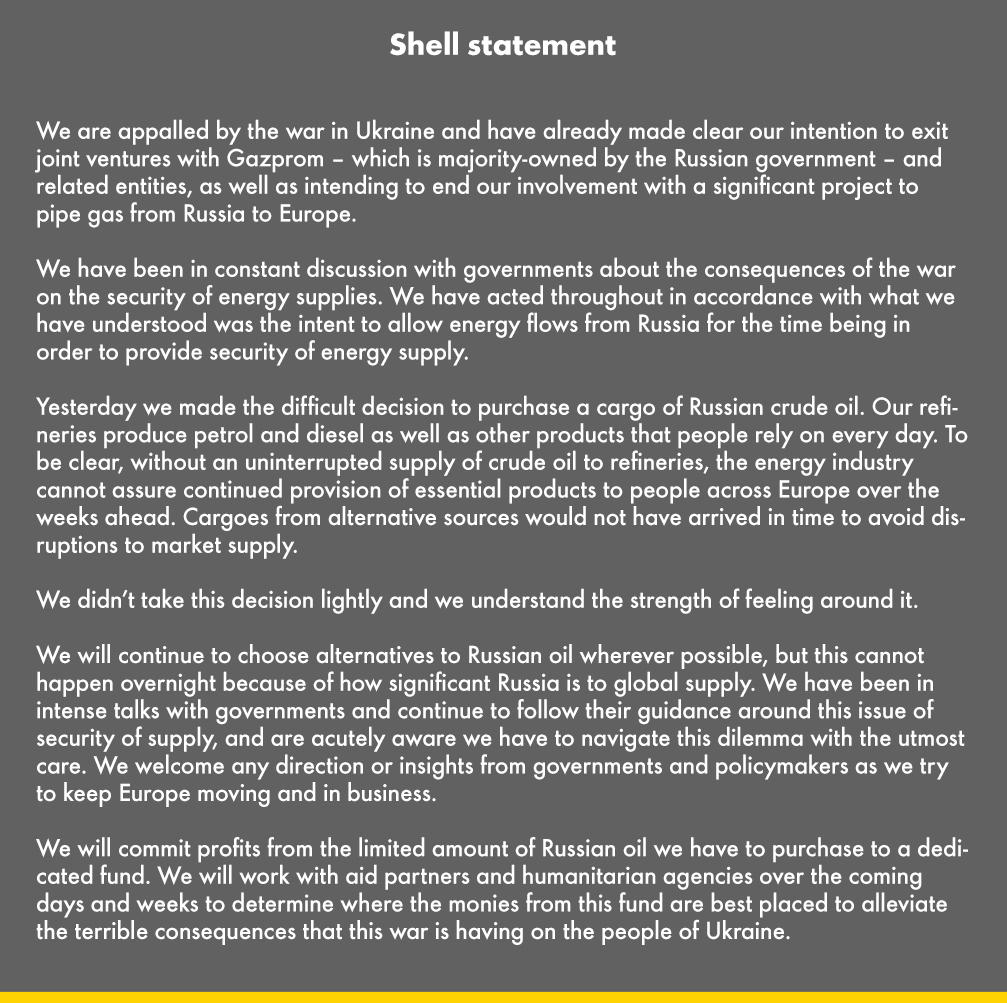

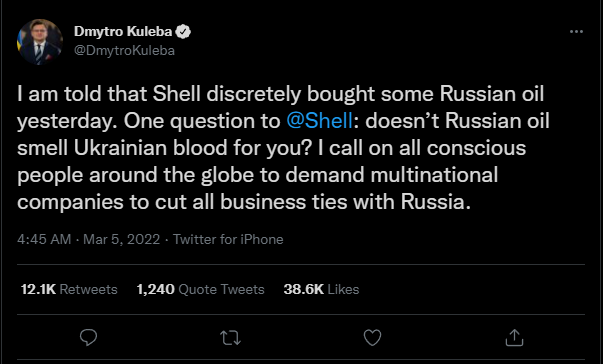

It was reported that Shell PLC had purchased 100,000 tons of Russia’s crude oil on Friday. The company paid $28.50 a barrel according to reports and did not violate any Western sanctions. The company stood by its decision on Sunday and announced that any profits would be put towards humanitarian aid for Ukraine. “We didn’t take this decision lightly and we understand the strength of feeling around it,” Shell said. Ukraine’s own foreign Minister Kuleba criticized the companies decision in a tweet on Saturday morning. The company returned, later on, to state They “will continue to choose alternatives to Russian oil wherever possible, but this cannot happen overnight because of how significant Russia is to global supply,”. With blood in the streets, one can only think of Warren Buffet’s famous quote “be greedy when others are fearful, and be fearful when others are greedy” but this may not be what he had in mind. Shell wasn’t the only person looking to benefit from difficult circumstances.

Renowned investor Carl Ichan reported a sale of his last 10% in $OXY. The activist investor stepped away with $1 billion in profits. Oil continues to surge as crude futures near 2008 highs at 140.