Apollo Global Joins Twitter Takeover Scheme

Apparently now Apollo Global Management is interested in joining the bid war for Twitter, the WSJ reported (citing people familiar with the matter). Apollo could potentially facilitate Elon Musk’s potential offer with either equity or debt, after Elon stated last week that he was looking to straight up acquire the company (after getting a lawsuit filed against him in the NY district court).

Sources claim that Twitter will staunchly rebuke Musk’s offer for acquisition of the company. They are currently slated to report earnings on April 28th, and there is a good chance they will publicize their stance in their earnings report.

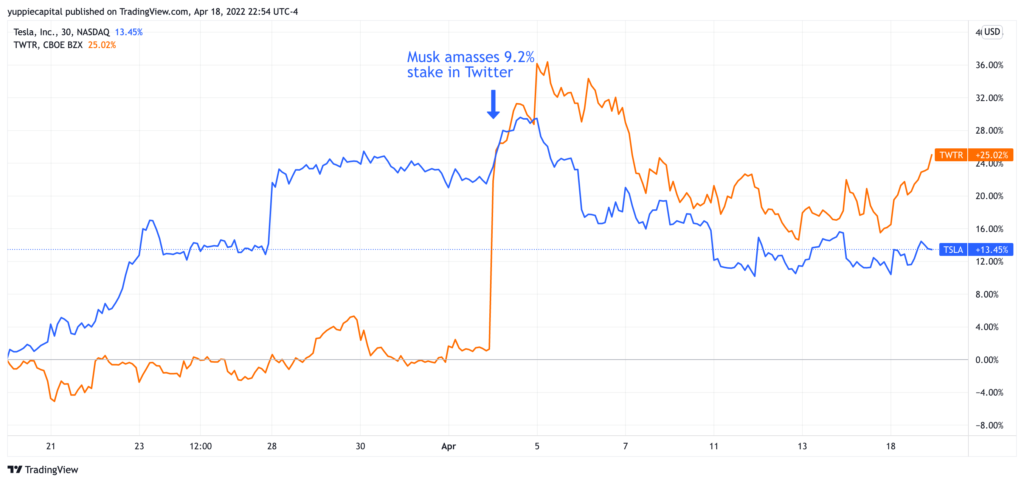

The laundry list of potential deal-makers just keeps growing and growing, with Morgan Stanley now in the mix to support a deal of some sort. Elon is truly a visionary, tbh. This man makes one slightly outlandish business proposition, and the whole world stops. Tesla has lagged behind Twitter following the news of the business savant’s new position in the social media company.

Although this deal is virtually all anybody talks about, there are some intricacies to it. This potential deal with either Apollo Global Management or Morgan Stanley would be one of the largest leveraged buyouts in the history of the universe. Typically, leveraged buyouts will utilize equity from the company to be acquired as leverage from the buyer, hence the term “leveraged buyout.” This aspect makes the potential Twitter deal a little more intricate. Twitter is ostensibly a pretty poorly run company, unable to find the monetizable niche that social media companies like Meta (still hate Zuckerberg) have been able to do. Twitter struggles in cash flowing, and has less than favorable debt to equity values.

Musk’s current bid for Twitter comes in at $54.20 a share, although with close to zero details surrounding his ability to finance the deal. Although, clearly firms such as Apollo and Morgan Stanley have offered debt financing. Any potential deal would likely come with heavy resistance from the Twitter board, with their newly adopted “poison pill” strategy. With this strategy, if Musk acquired more than 15% of the company, it would provide additional board members the ability to amass more stock at a discounted rate, thus diluting Musk’s overall position.

Personally, I would love to see a leveraged buyout take Twitter private. Everything this dude touches turns to gold. Twitter could be utopian when all the shit posters join en masse and create arguably one of the most humorous and toxic environments known to man. Book it.