Are We Recession Bound?

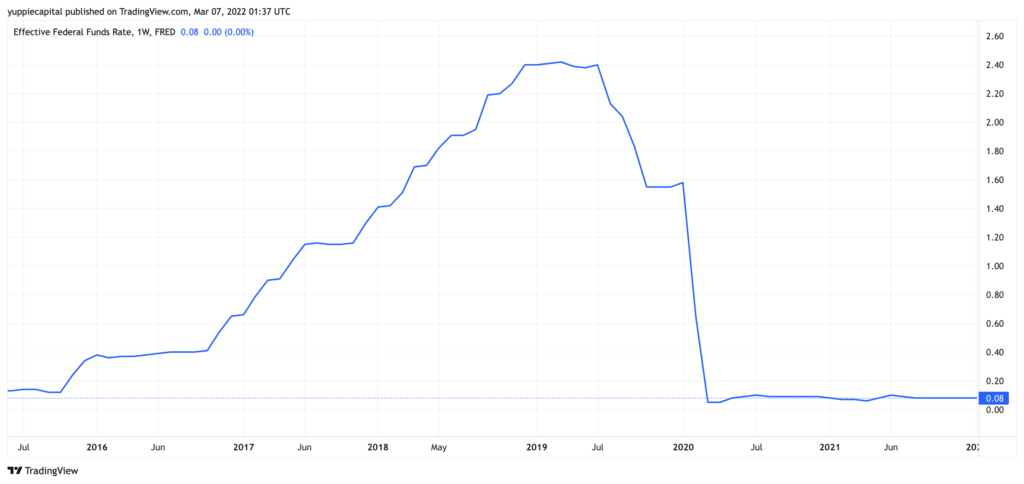

With the most intense and aggressive economic decline in the history of the world, the COVID-19 recession lasted only two months, the shortest ever in U.S. history. God only knows what the ramifications would have been without Federal Reserve intervention, although it’s been very clear what their role has played in our post-COVID “economic recovery.” We’ve seen numerous all time highs in the equities, commodities, and housing markets. Market caps in our favorite companies have gone absolutely nuclear. Household debt has also absolutely skyrocketed. All of this taking place under artificially low interest rates, and obscene balance sheet expansion by the Federal Reserve. QE IN PERPETUITY (not really, but can you imagine)?

Although we have been living in what has presumably been a strong and robust post-COVID economy, the U.S. economy is precariously perched upon a peak which has been scaled predominantly via inorganic monetary forces (quantitative easing, low interest rates). This ultimately begs the question, where do we go from here?

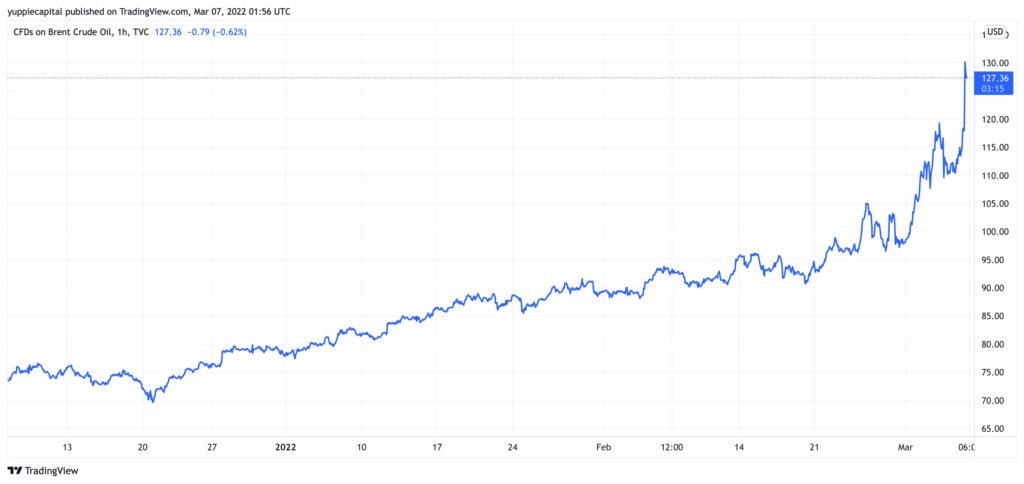

For starters, insane price action in oil prices proceeded 10 of the last 12 post-WWII recessions. That doesn’t bode well for us, seeing as how oil has gone absolutely parabolic in lieu of the Ukraine & Russia fiasco.

Another key indicator is vast monetary expansion led by central banking syndicates. We’ve seen the Federal Reserve balance sheet grow absolutely astronomically since the onset of the COVID-19 pandemic, when they went as far as to even backstop the entire corporate bond market, something they’ve never done before. People also forget that the Fed came to the closest they ever have to buying individual stocks when they held actual corporate bonds ETF’s at one point. What a time to be alive. All of this fun money will ultimately be coming to an end, as the Fed plans on ending COVID induced quantitative easing this month. Gone, but never forgotten.

While unemployment is at historic lows, looming interest rate raises by the Fed will certainly slow down economic growth, as companies will be loading up on debt much less so than they would have in a lower rate environment. This puts pressure on continued economic growth.

Inflation running rampant also doesn’t help the case of a perpetual bull market. With American’s racking up more debt than they ever have amidst this recovery, they will have even less disposable incomes to help fuel the economy. Corporate earnings will also get hurt as a result, ostensibly driving down equities.

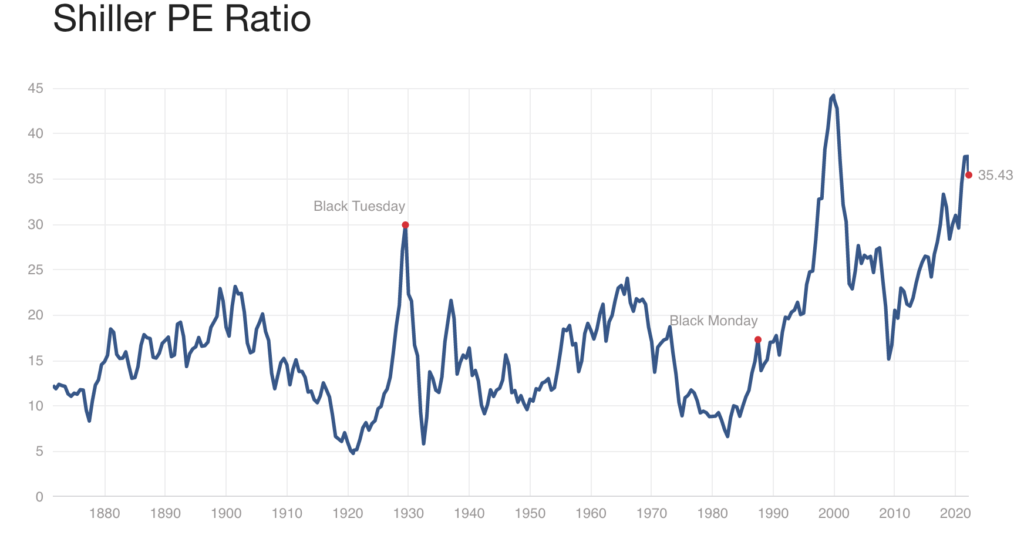

Oh yeah, not to mention that the stonk market is trading at all-time highs (although major indices have seen at least 10% drawdown from ATH’s in January).

Unfortunately it seems as though the U.S. economy is facing virtually every economic headwind in existence. The Russia/Ukraine shakeup could be the catalyst that pushes this country into a major recession. And this time, we won’t have Federal Reserve intervention, although I suppose that’s not totally off the table at this point. However, the “Nike-shaped” recovery we’ve seen is perfectly indicative of the most immaculate bull run that has ever existed in the history of the world. It was fun while it lasted. ‘Till next time.