Asia’s Junk Bond Market Shrivels

What once was a flourishing and thriving credit market, Asia’s junk-bond market debt issuance has slowed to a grindings halt, thanks specifically to defaults en masse from Chinese property developers. Before Chinese developer Evergrande group began U.S. dollar debt defaults, they were one of the few corporations single handedly propping up Asia’s junk bond market.

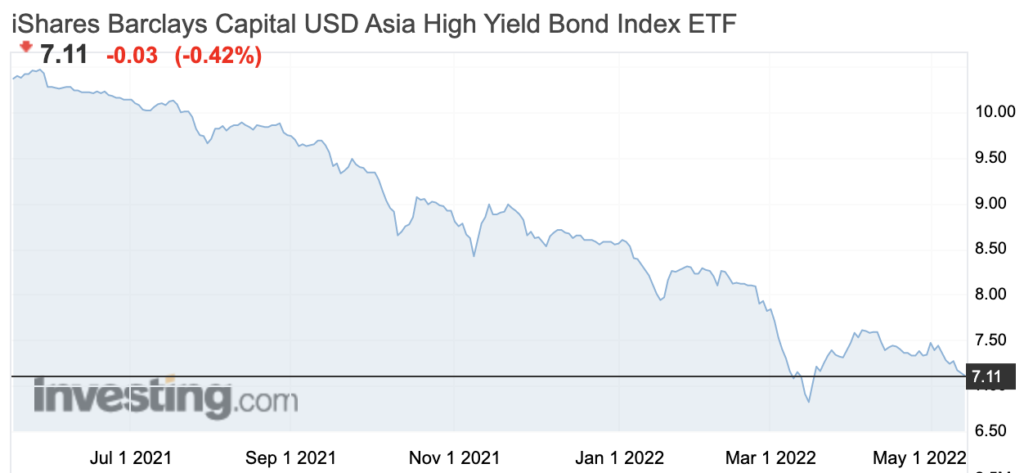

According to the Wall Street Journal, the dollar-bond market reached nearly $300 Billion in size. Amidst defaults from Evergrande Group and most recently Sunac China Holdings Ltd., the total market value for the Asian high-yield bonds, is now $184 Billion (excluding defaulted debt).

This has virtually been the theme for all of 2022. The risk-off trade has materialized in every way, shape, or form. U.S. capital markets are off to a tumultuous start this year, shockwaves have rippled through the broad crypto market, and the U.S. bond market is suffering.

Chinese regulators triggered the frenzy in the Asian high yield credit market. Imposing corporation’s leverage capabilities slowed down in flows of new debt, and a slowing real estate market within China unleashed the default bloodbath we’re watching unfold currently. According to data from Dealogic, so far this year through May 10th, Asian high-yield debt issuers have raised just $2.5 Billion in new debt. During this same time in 2021, that number was…

*drumroll please*

$24.2 Billion…

This marks a casual 90% decline, which honestly isn’t that far off from a 73% decline in U.S. high-yield debt issuance. These problems are likely to persist within high-yield debt issuers. Ostensible slowing of economic growth, and rising rates from the Fed will add further headwinds for corporate borrowers to sell new dollar bonds. What’s unclear at the moment is how many more defaults will come prior to the Asian credit market bottom. More stringent COVID measures in China certainly doesn’t bode well for their already struggling property market. There is clearly still room to fall, the question is, where do we bottom?

Meanwhile Filippo Gori, CEO of JPMorgan in Asia Pacific said on Bloomberg Monday night, “We are building in china for the next 25 years.” Bold move, Cotton. Let’s see how that one plays out.