Atlanta Fed Cuts Q3 GDP Forecast

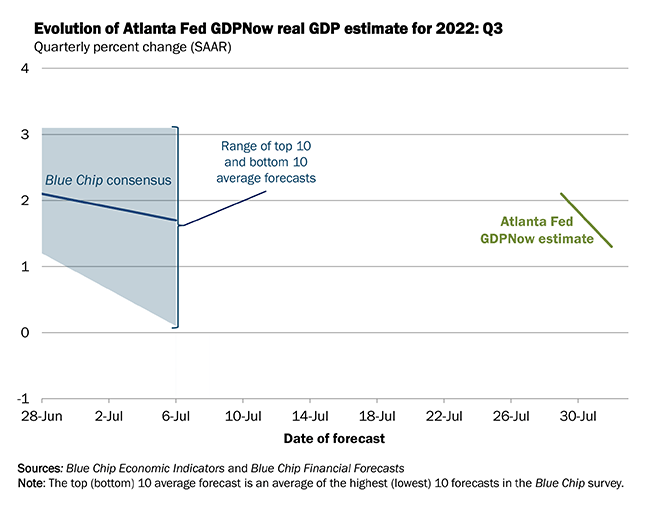

When it rains, it pours. After posting two consecutive quarters of negative GDP growth, the Atlanta Fed officially revised their Q3 GDPNow forecast down to just 1.3%, down from 2.1% back from last Friday. After the ISM Manufacturing report was published on Monday, along with the construction spending report from the U.S. Census Bureau, the Fed quickly reacted and immediately slashed their GDP forecasts, citing a decrease in both personal consumption expenditures and private domestic investment growth. It’s all coming together.

Following the release of the data, the personal consumption expenditures growth was revised from 2.5% to 1.5%, while real gross private domestic investment was revised from -1.4% to -2.1%. Yikes. And historically speaking, the data presented in the ISM Manufacturing Index is less than ideal. I guess my recession (or lack thereof) prediction doesn’t bode well.

And just for reference so everyone knows how outlandish (but still potentially accurate) of a prediction I decided to make.

Although I don’t know how anyone couldn’t have seen Friday’s hotter than expected PCE print to send stocks nuclear (called it). Although it’s probable that these rallies are ultimately short lived. We are seeing consumers’ purchasing power ripped to shreds amidst record levels inflation, and virtually zero real wage growth. Fed rate cuts to increase “efficiency” and “innovation” can only do so much, especially when funny money environments have just been leading to stock buybacks and astronomical transfers of wealth. The truth is, we are likely in a recession, but I don’t know that I would necessarily disagree with those who pose that this recession will be mild. That’s likely going to be the case. Historically speaking, we are in a recession, but it’s not a recession that will totally upend the U.S. economy. That is, unless the whole global financial system collapses first.