Bond Market Going Brazy

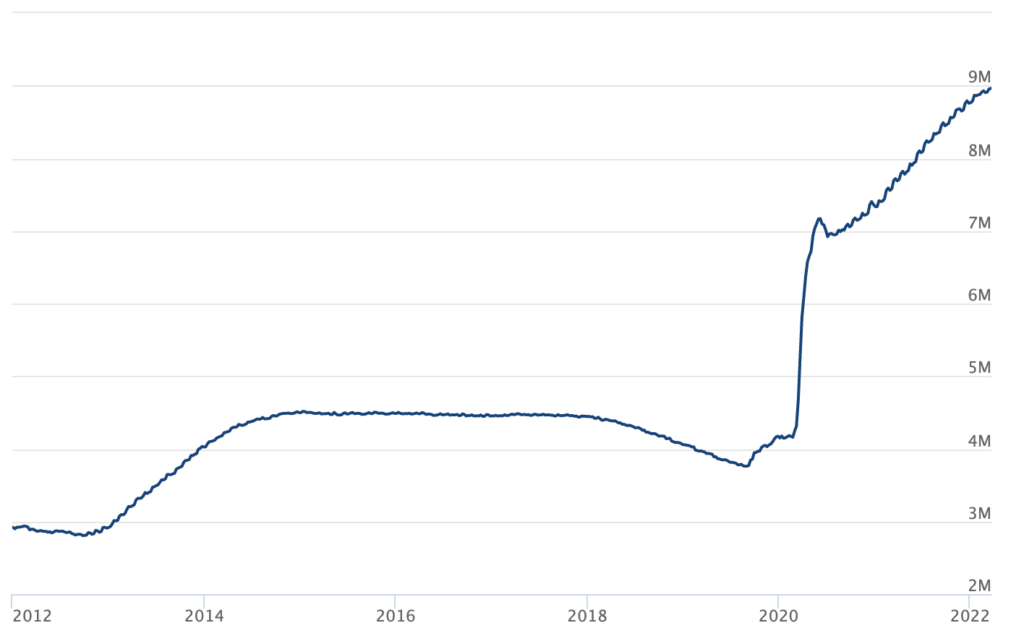

While stocks have been seeing some relief in recent weeks, the bond market has continued to implode, as the race for liquidity is on as the Fed finally exits. The Fed announced that they had planned on ending the QE asset purchase program in March 2022. Gone, but never forgotten. The QE program the Fed had enacted just two years prior in the onset of the COVID-19 pandemic (crazy to think this was two years ago), the Fed accumulated U.S. Treasury debt, and mortgage backed securities. This program swelled their balance sheet to nearly $9 Trillion, which is honestly just crazy to think about.

While it’s ostensibly true that equities markets have flourished during QE, the same could be said for bonds as well. As the Fed exits their massive asset purchase program, the bond market has responded in nuclear fashion (not the good kind)

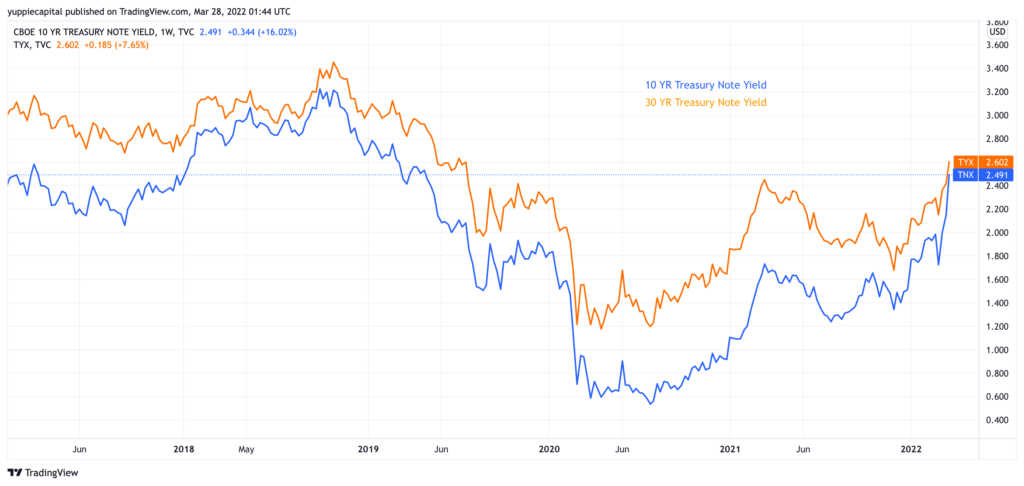

Yields are making their way back to levels not seen since mid-2019 (much like mortgage rates). With liquidity running dry, the bond market has been struggling, and likely will continue to struggle throughout the year, and potentially into 2023. With the U.S. continuing to just print absolutely heinous inflation numbers, bonds will continue to struggle. Bonds currently haven’t seen this worse of a year since the 1980s, when the entire market just absolutely collapsed in under itself. In an interview with the New York Times, Kathy Jones (chief fixed income strategist at Schwab Center for Financial Research) stated, “It’s been a decade since we’ve seen wholesale declines like these…”

The Bloomberg Aggregate Bond Index is already down over 6% this year. This ultimately begs the question, where do you even put your money into at this point? Equities markets are struggling, the bond market is bleeding, real estate is likely on its way out, too. Commodities are probably somewhat of a safe haven currently, although one can surmise that with rising rates from the Fed will put an end to enormous CPI prints, but the jury is still ultimately out on the effectivity.

Ultimately, there are several signals that indicate that we are recession bound. The rate on a 30Y fixed rate mortgage is starting to decouple from the 10Y treasury yield. Mike Shedlock points out that six of the last seven recessions have began shortly after the spread between the two has exceeded 200bps. PLEASE KEEP YOUR ARMS AND LEGS INSIDE THE VEHICLE AT ALL TIMES.