China’s Real Estate Market Is Faltering; Enter Liquidity

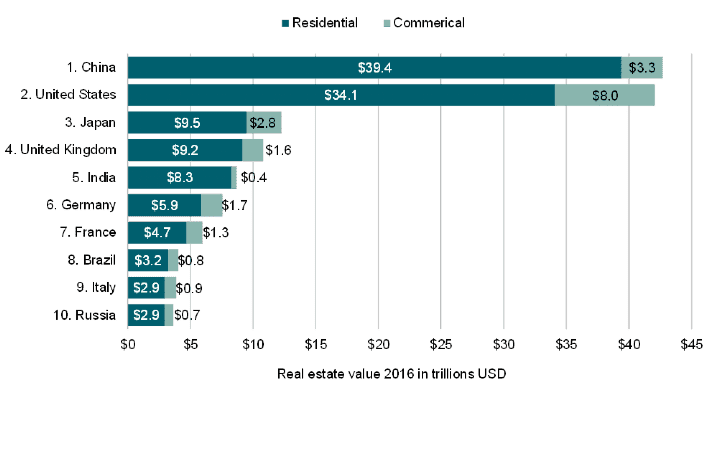

With mortgage boycotts taking place in China from July over unfinished projects and angry potential buyers, the world’s second largest economy is reeling and putting pressure on the country’s government and central bank. Not to mention, China’s real estate market is ostensibly the largest in the entire universe! On a more serious note, these dudes are really about to take over everything, huh?

According to people familiar with the matter, Beijing is delivering “special” loans (not a bailout, though) in the amount of 200 Billion Yuan (~$20.3 Billion) to make good on housing deliveries to buyers. Bloomberg is reporting that this would be the largest deal Beijing has made to date in order to keep a total shit storm from unfolding in their hemorrhaging housing sector. Probably second to the greatest central bank in the history of the world, the Federal Reserve with their ’08 QE special delivery.

Although in stunning fashion this hasn’t been classified as a “bailout”, China is operating this lending facility via several specific banks within China (China Development Bank and Agricultural Development Bank of China). So basically, it’s a total bailout of the housing market sector within China. Just own it, Xi Jinping! It’s super simple, we do it all the time. This lending facility is targeted for homes that have been purchased, but have not yet finished construction.

Rates across the board in China were unexpectedly lowered by policymakers in an effort to spur growth. China has been struggling with growth amidst their COVID-zero policy which has done nothing but totally upend the entire country’s economy. Buckle up people it’s about to get brazy in China, and tbh, I’m here for it.

TIME TO FORCE FEED THE LIQUIDITY, BABY. ALL ABOARD THE LIQUIDITY HYPE TRAIN.