Consumer Confidence Goes Down The Drain

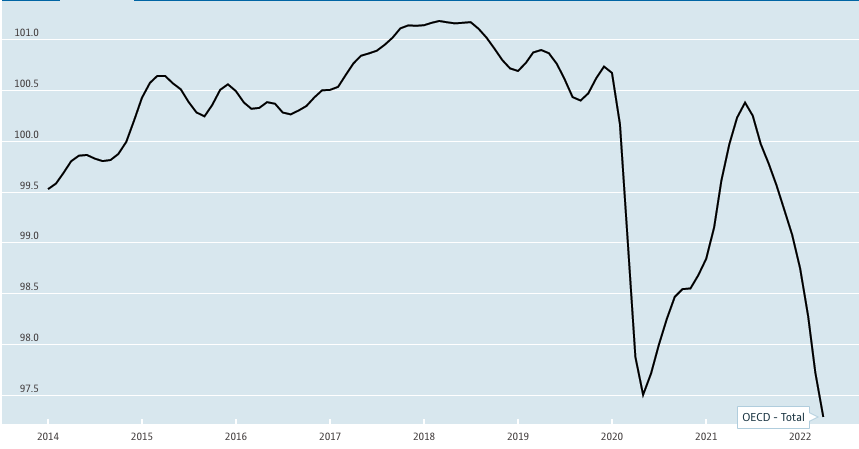

Just after the University of Michigan Sentiment released record low sentiment numbers, The Conference Board’s consumer-confidence index (measures overall Americans’ attitude toward jobs and the economy) absolutely hemorrhaged in the month of June. The expectation was a reading of 100.0, and the headline fell to 98.7. This is down from a reading of 103.2 last month. YIKES. Additionally, the board’s expectations index (measures consumers’ short-term outlook on employment, and general macro conditions as a whole) reached a low of 66.4 in June, down from 73.7 the month prior.

The Conference Board had just recently released a reported (covered by yours truly) which outlined various CEO’s outlook on the economy, specifically whether or not they believe we’re in a recession, or if we are due to be in a recession very shortly. It seems like just about everybody and their mother is talking about the looming economic headwinds that the country will be facing. Mostly because every other headline surrounds INFLATION.

We’ve also seen the personal savings rate tumble to levels not seen since the GFC, which doesn’t exactly paint the best picture for the imminent future. Americans have been burning through what little savings they have at the moment to fight rising costs across the board (housing, food, energy, etc.). The list goes on.

We are ostensibly seeing consumer spending decline now (thank god). According to Bernard Baumohl, chief global economist at the Economic Outlook Group, “When consumer sentiment and confidence decline in tandem, spending usually decreases with it…” And the May retail sales number was a reflection of just that.

And for the ostensible future of the U.S. economy, read our post regarding the precarious state of the U.S. economy. Virtually every leading and lagging indicator which determine the future state of the economy points in a bad direction. We saw the yield curve invert back towards the end of March. This has been a pretty good recession indicator from 1-2 years at this point in time. At the very least, we will enter a recession within the next two years (assuming we aren’t already in one right now). Housing starts are also down, which isn’t necessarily a good thing either. The unemployment situation seems to be under control at this point, but that hasn’t stopped companies from beginning to institute layoffs en masse. And we don’t even need to get into CPI but there’s also that lol. We are in the midst of virtually every economic headwind, and at this point, everyone will be talking about it. Where do equities go from here, though? That’s the ultimate question. The Fed will be forced to show their hand, and they will determine our fate.