Double-A Rating

A volatile week in the market was fueled by mixed reports from large tech giants that reported their earnings this week. As expected, Netflix missed (shocker), Google missed (actual shocker), FB reported better than expected (nice), Amazon missed (shock), and AAPL beat (as usual). The importance of the earnings reports was found in the conference call that would give guidance into the rest of the year as a multitude of issues continues to threaten profits.

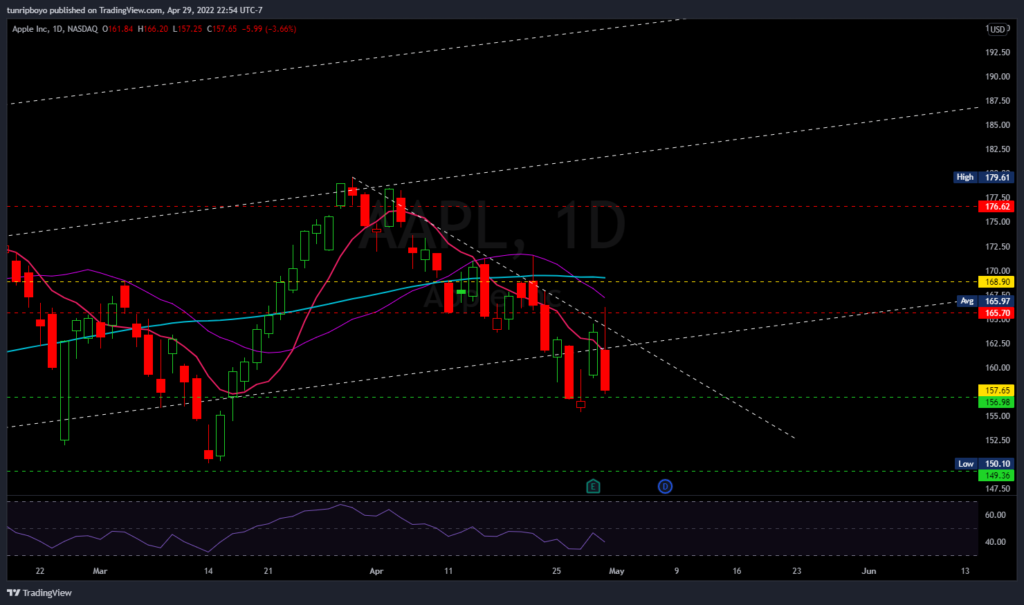

AAPL reported on Thursday, April 28th after market close. The company reported an EPS of $1.52 against the analyst expectations of $1.43. They grew their service revenue by 17.3% YOY and declared a cash dividend of $0.23 per share on the common stock, reflecting an increase of 5%. This was a fantastic report as usual but the conference call quickly informed investors of a rocky future. CFO Luca Maestri warned of a potential hit from supply chain restraints in the coming months. As a result, the company stated an $8 billion hit is possible next quarter. The past two earnings calls have offered a similar outlook but indicated a $6 billion hit as expected. A poor outlook spooked investors and sent the stock down to its support level around 156.98. It is unlikely the company takes a large hit in the future but it is kind of them to warn of the possibility. APPL is ingrained in most of our everyday lives. The integration between our watches, tv, headphones, phones, laptops, and tablets is convenient and hard to believe those who get the chance to upgrade products won’t. Moving forward, any downturn in shares for the company is a buying opportunity. The stock closed on Friday at 156.65 after it was rejected at the downtrend started on March 30th of this year. The next leg down offers 149.36 with a few spots in the middle. To stay up to date on those (literally) you can check out my Twitter! I’ve frequently mentioned my belief in the options markets’ ability to predict future moves and thanks to @OptionsHawk on Twitter, AAPL may be in luck for the short term. Heading into earnings a combination of sales took place with the May 27th $165 calls being sold into earnings (likely an earnings play) for $4.40 a pop and the June 3rd $160 puts being sold for $7.70 apiece. Earlier in the month, it was noted that $185 puts expiring May 13th were also sold but that seller is likely feeling the pain at the moment. Options are expecting the stock to stay in a range for the next few weeks or weeks as the worst (I think) is behind us. With volatility at yearly highs, premiums on the long side are cheaper and worth watching. The Fed meeting scheduled for 5/4 is an important event likely maintaining the VIX’s strength. Now for Jeff Kisses…

Amazon missed earnings for Q1 2022, reporting an EPS of -$7.56 vs analysts’ estimates of $8.55. Amazon said that it expects net sales to be between $116.0 billion and $121.0 billion for Q2 2022, representing growth between 3% and 7%. Cramer was quick to hop on CNBC and state that this report could drive unemployment with the potential layoffs of Amazon’s warehouse workers. “The pandemic and subsequent war in Ukraine have brought unusual growth and challenges,” Amazon CEO Andy Jassy said. The shipping giant has been facing economic challenges as inflation and costs are on the rise. “This may take some time, particularly as we work through ongoing inflationary and supply chain pressures, but we see encouraging progress on a number of customer experience dimensions, including delivery speed performance as we’re now approaching levels not seen since the months immediately preceding the pandemic in early 2020,” Jassy said. On a brighter note though the companies AWS increased 36.5% YOY, posing a threat to Microsoft & Google. Amazon’s Prime Day will take place in July so there is something to look forward to. AMZN was down 14% during Friday’s trading session and once again the options market offers some guidance. According to @Optionshawk, “$AMZN May/June $2600 calendar call spreads opening 1000X into early weakness seeing lingering weakness but rebound in June”. The stock is nearing its 2020 April to June consolidation area of around 2300 a share. For investors looking to reap the benefits of a 20 to 1 stock split, the lower price is beneficial.

An eventful week the last week of April has been and to kick May off it likely continues to remain somewhat turbulent. The Federal Reserve meeting is scheduled for 5/4/22 and is an important event to keep on your calendar. In 10 years it is likely this correction will feel like nothing and in the words of Nick Maggiulli, just keep buying.