Europe Energy Scene Is A Literal Nightmare

As a result of the world’s denouncement of Russia (rightfully so) in lieu of their invasion of Ukraine, Europe is especially struggling to survive an energy crisis as their dependence on Russian oil & gas is becoming more wide known. The Wall Street Journal is reporting that the U.S. is sending liquefied natural gas en masse to European countries in an effort to assuage their dependence on the liquid gold of the Motherland. President Biden made his way to Brussels to announce this effort earlier this week.

According to the report, the U.S. is sending 50 million cubic meters of LNG to Europe through 2030. GAS. Is LNG technically classified as “green energy?” Clearly I’m being facetious, but these numbers are pretty hefty and I’ll say it again; the COP26 climate summit was for NOTHING. Great job, everyone.

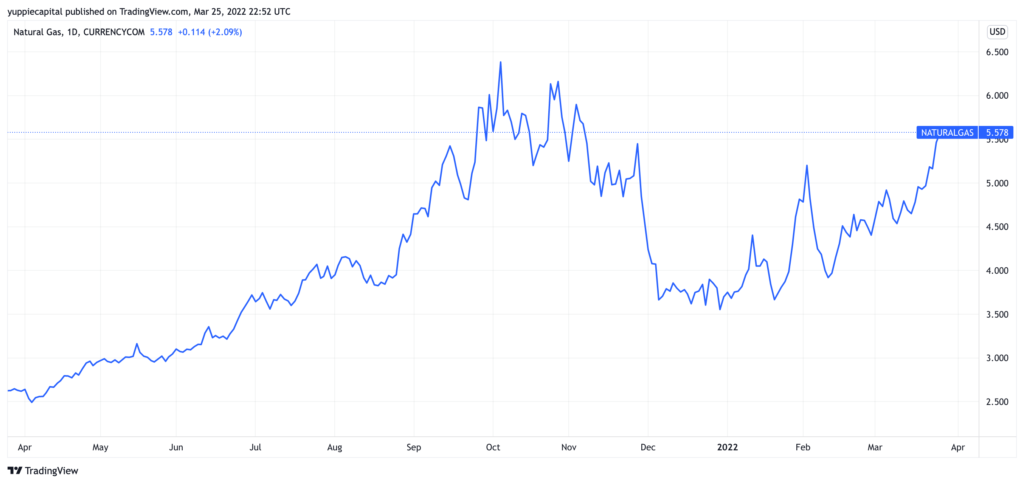

In any case, European countries are also scrambling to sign energy contracts with literally any other country than Russia, namely within the Middle East and Africa. America is remaining steadfast in their operations, apparently “…running their export terminals at full capacity…” This should certainly fix the supply chain issue that we’ve been facing for nearly a year and a half. Natural gas also had an immaculate run up before this winter, before leveling off and gaining more traction throughout the start of 2022.

The fight for energy independence from Russia also directly contradicts the United States’ effort to curb greenhouse gas emissions, and retain integrity in their efforts to pursue net-zero emissions. As we are globally producing more LNG, and building more infrastructure to support it, we are by virtue of that increasing our total carbon footprint. While I don’t have the math on this, I think that is a logical conclusion to make. This is the lesser of two evils, I suppose. The U.S. did say that their LNG export capacity will “expand 20% by the end of the year.”

So to retract my earlier point, I guess natural gas is now considered green? Let’s just wait and watch institutional money start flooding the sector. Book it.