Fed Put Incoming?

With the Fed expected to deliver another 75bps rate hike this week to quell the inflationary shitstorm they unleashed out of Pandora’s Box, investors are betting that the Fed will capitulate and reverse course shortly thereafter. Analysts are estimating that the Fed will eventually normalize ~3.3% EFFR, only to begin cutting rates back down to 2.5% by mid-2024. While the jury is still out as to whether or not we are in a “real recession” we are clearly seeing a decline in economic growth, waning consumer confidence, and inflation at 40 year highs. With that being said, the Fed will absolutely not hesitate to reverse course and save the economy by reducing rates…or maybe they won’t?

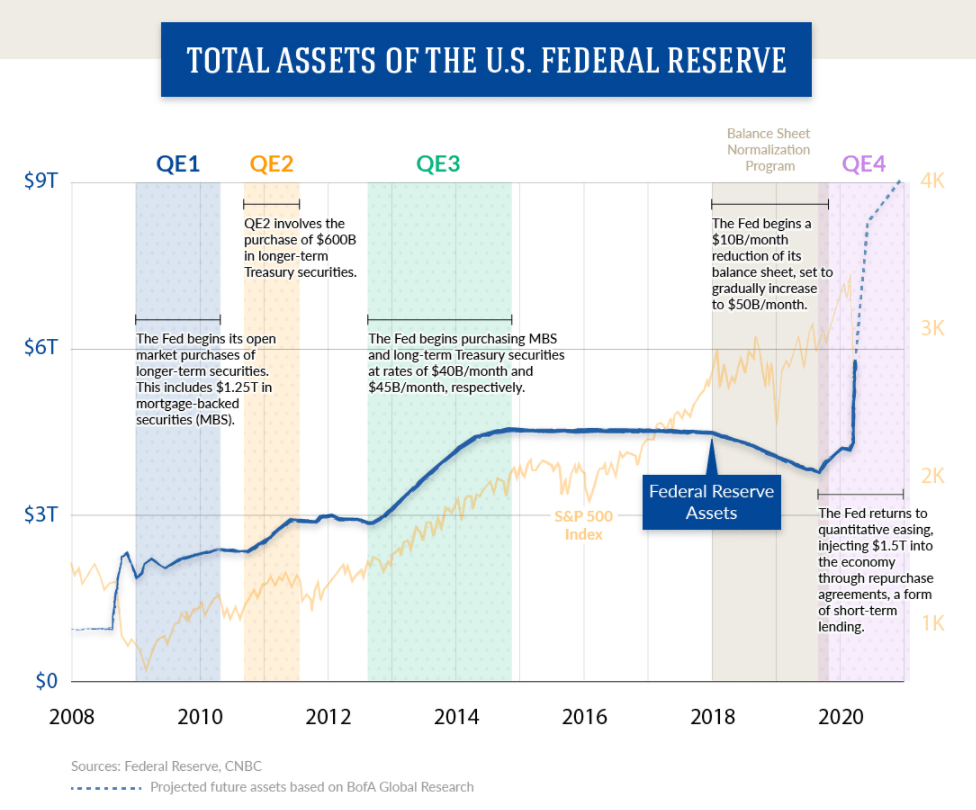

Historically speaking, the last three recessions saw the Fed step in and invoke some type of interest rate reduction and/or quantitative easing initiative. As a side bar, let’s just pour one out for the most epic bull run in the history of the universe which came as a direct result of QE4. Gone, but never forgotten. Anyways, it’s hard to imagine that the Fed will resume QE programs after they have basically created the largest asset bubble ever known to man (virtually in every asset class). However, it is entirely possible, and rather likely, that the Fed will begin to reduce rates after just making it into the mid 3% EFFR range. Amazing, I know.

For reference, the Fed aggressively cut rates in the last 3 recessions. During the DotCom bubble, the Fed cut rates by 475bps, to which stocks were finally able to rebound. And again in 2008, the Fed cut rates by over 500bps AND backstopped the banks in order to save the entire global economy from evaporating into thin air. And obviously, in March of 2020, the Fed instituted ZIRP, while simultaneously backstopping the corporate bond market DIRECTLY, and then continued asset purchases throughout all of 2021 and somewhat into 2022. You gotta love it. Powell is an absolute dog and I love it.

The bond market has also been screaming bloody murder at this point, serving as another likely harbinger to the Fed Put. The 30Y U.S. Treasury is currently trading at just over a 3% yield, nearly 2x what they were trading at in December 2021.

As we have arguably seen peak inflation and peak yields, we haven’t quite seen peak EFFR, which will then subsequently trend lower as analysts are currently predicting. But while we are about to watch the “Fed Put” rear its (beautiful) head, does that mean just hammer the bid on the S&P? Not exactly. Looking back to the GFC, the cyclical top in yields occured in June ’07, with the cyclical bottom coming a short time later during December ’08. During this time, the S&P 500 shed a modest 42%. Not a big deal, really. Even as yields reached their cyclical bottom during that time, the sell-off in equities continued for 3 straight months, bottoming in March ’09.

The point being, while we are likely about to watch the Fed Put before our very eyes, be wary of when you hammer the call options and/or buy orders…