Fed Up (1% & 3%)

“With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong…In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate.” the fed stated in today’s meeting. The interest rate is now set at 1% and will quickly influence the mortgage rates, car loans, and interest payments on credit and debt. Those sitting with cash in the bank account will benefit from this as saving during a slow down in the spending improves with higher interest rates.

The larger-than-expected hike insinuates that the Federal Reserve believes the economy is strong enough to withstand high-interest rates. Larger hikes are intended to fight off inflation by reducing demand. “The forward guidance confirms what markets have been betting on for weeks. Traders are largely pricing in 0.5-point hikes to be announced at the FOMC’s June and July meetings. Forecasts for the September policy decision are much more varied but still point to another double-sized increase. That would place the upper limit of the benchmark interest rate at 2.5%, sharply higher than the 0.25% limit seen as recently as early March.” (Market Insider)

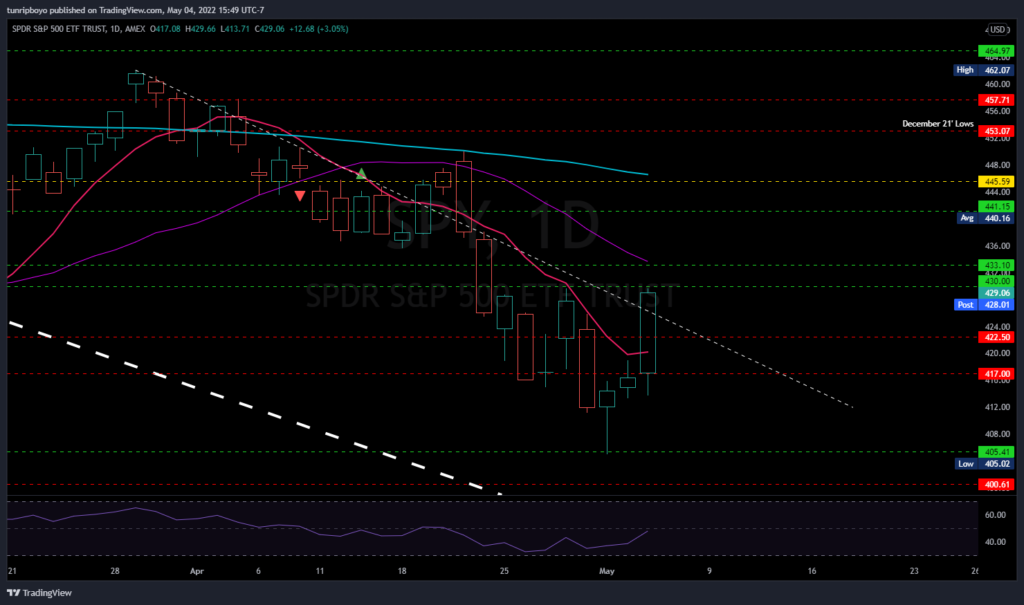

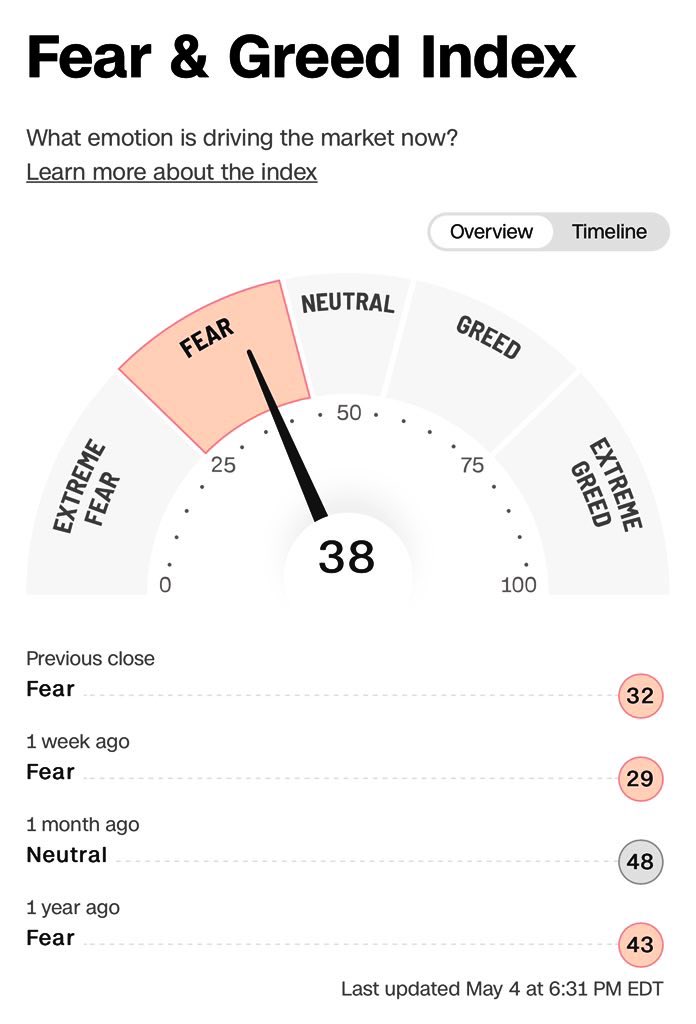

In light of higher rates, the market rallied across the board. The “Dow Jones Industrial Average finishing up 932.27 points, or 2.8%, to 34061.06, marking its biggest one-day gain since November 2020. The S&P 500 jumped 124.69 points, or 3%, to 4300.17 for its best day since May 2020, while the Nasdaq Composite added 401.10 points, or 3.2%, to 12964.86” according to the Wall Street Journal. After tagging 405 on Monday, the market has rebounded past last week’s highs. Bullish sentiment saw signs of life but it’ll take more than a 1-day rally. Since mid-March, greater than 1% days in the S&P have been followed by bearish days, wiping out the previous days’ gain or exceeding it. Signs to look out for include the Breadth (advancers vs. decliners), VIX, and the levels that continue to offer buy and sell areas. Overseas markets have remained fragile as China’s lockdown continues and European tensions continue. Taking a look at the S&P below you see the downtrend starts on March 22nd and attempts to break through during today’s session. 430 is the next resistance to break and there are buying opportunities (hopefully) at 417 & 420. The volatility index (VIX) collapsed and is sitting at $25. The VIX action has remained in line with the downtrend and once it hits 20, the market gives some gains. So far VIX > 32 is a buy and VIX < or = 20 are the sell zones.