From Bedroom to Backcountry

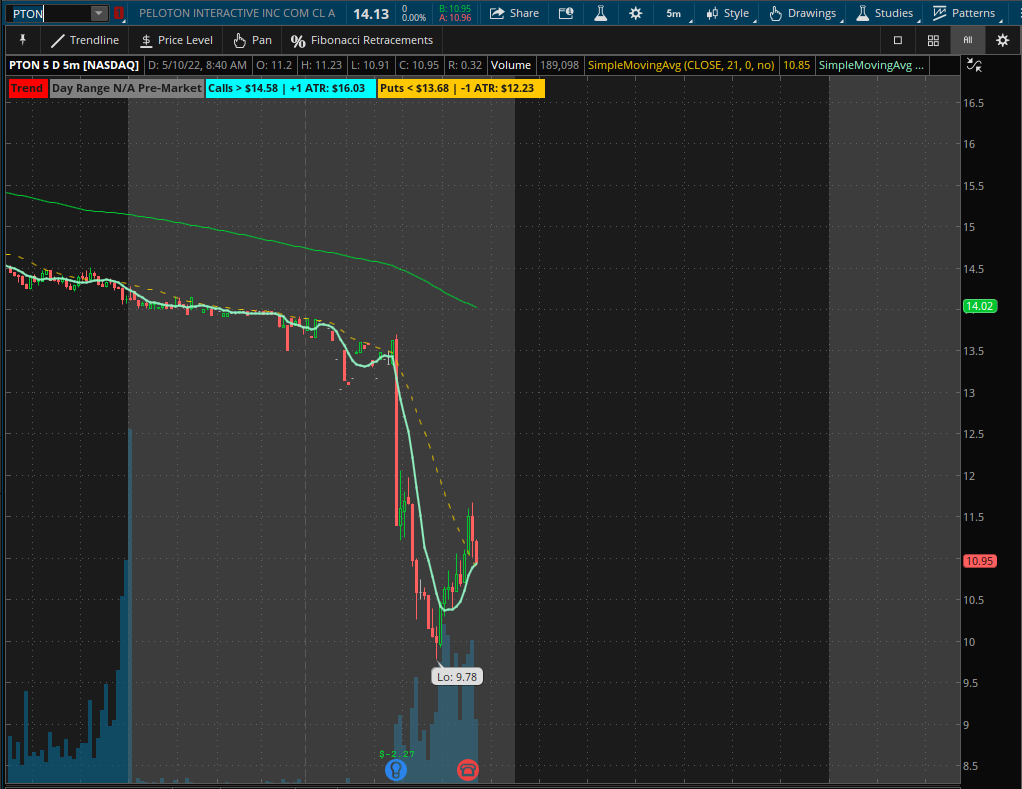

Peloton shares fell 25% early Tuesday morning after the company posted a huge loss and poor outlook for the fourth quarter. Shares fell below 10$ briefly in the premarket trading session.

With the transition from outdoor activities to indoor yoga and fitness, Peloton seemed promising at the start of the pandemic but has since failed to deliver. The company reported a loss of $22.7 per share vs. analysts’ expectations of 83 cents. Revenues came in at $964.3 million vs. the $972.9 million that was expected. This is likely due to the market and investors overhyping the company. Peloton reported a steep decline in sales and inventory pile-up in its warehouse. It expects a weak outlook for the fourth quarter with demand easing. “Our users are highly engaged, and our subscriber churn rate is less than 1%, which is the best I’ve seen,” McCarthy said in his letter. “The challenge and the opportunity today is to sustain and extend this success.” In the face of uncertainty, the company is looking to restructure its capital use and earlier this week borrowed $750 million in 5-year term debt from both J.P. Morgan and Goldman Sachs according to CEO Barry McCarthy. Some more highlights from the report included Peloton facing high returns of its Tread+ machine, totaling about $18 million. “We’re still known primarily as a stationary bike company. The app has never been a focal point of our marketing campaigns or growth strategy,” he said. “The digital app needs to become the tip of the spear.”

It is unlikely that Peloton shares regain any of their 2020-21 gains in the next few years but investors holding the bag can hope. As usual, Twitter has a few comments and concerns that you can check out below.