From Jackson Hole With Love

As anticipated by many, the maestro Jerome Powell delivered a pain-inflicting talk at Jackson Hole two Fridays ago which sent quite literally everybody into a frenzy, and sent markets capitulating across the board. Pretty much everybody was frantically checking their account balances just to see them absolutely hemorrhaging (assuming you’re perma bull big dawg status, much like myself). Stocks haven’t quite rebounded as of yet after the initial reaction to the words of affirmation Powell spoke into existence (not the good kind, either). Jay-speak is alive and well baby!

Powell was notably much more “hawkish” than he has typically been during prior speeches surrounding the current state of economic affairs globally and within the U.S. Much of the focus was surrounding the rampant inflation that the country has been seeing, with just an absolute blatant disregard for “maximum employment.” To which the Fed Chair had this to say during his speech:

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

This speech also served as an ostensible harbinger for things to come, as his tone surrounding this talk exhibited a stark contrast as opposed to those in years prior.

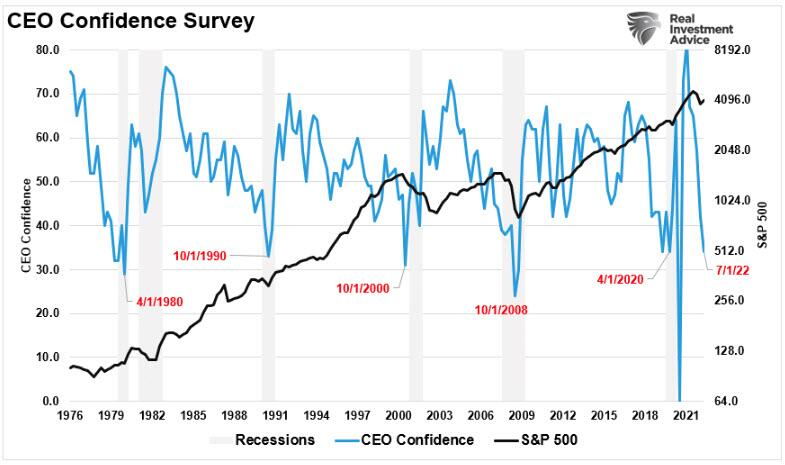

As Wall Skreet analysts have pointed to in the past, the economic uncertainty that lies ahead is largely predicated upon the unemployment numbers, which are a lagging indicator. Although at the moment things may appear rosy and pristine, that will likely change fairly quickly. The most recent iteration of the “CEO Confidence Survey” declined for the fifth consecutive month, falling to 34 from 42 the quarter prior. Any level below 50 shows an increasing pessimism amongst company CEO’s and their overall economic outlook.

In an environment where liquidity prevails as much as water in the god damn Sahara Desert, we are quite literally in for a rude awakening. Another thing to note is that the U.S. Dollar has shown absolutely no signs of slowing down, going on an absolute tear in the month of August (next to Natural Gas, lol), which has negative ripple effects on companies’ bottom lines.

What does this mean? BUCKLE THE HELL UP. PLZ KEEP YOUR ARMS AND LENGTHS INSIDE THE VEHICLE AT ALL TIMES (shoutout Fringe Guy).