Goldman Insists Lithium, Cobalt, & Nickel Due For “Sharp Correction”

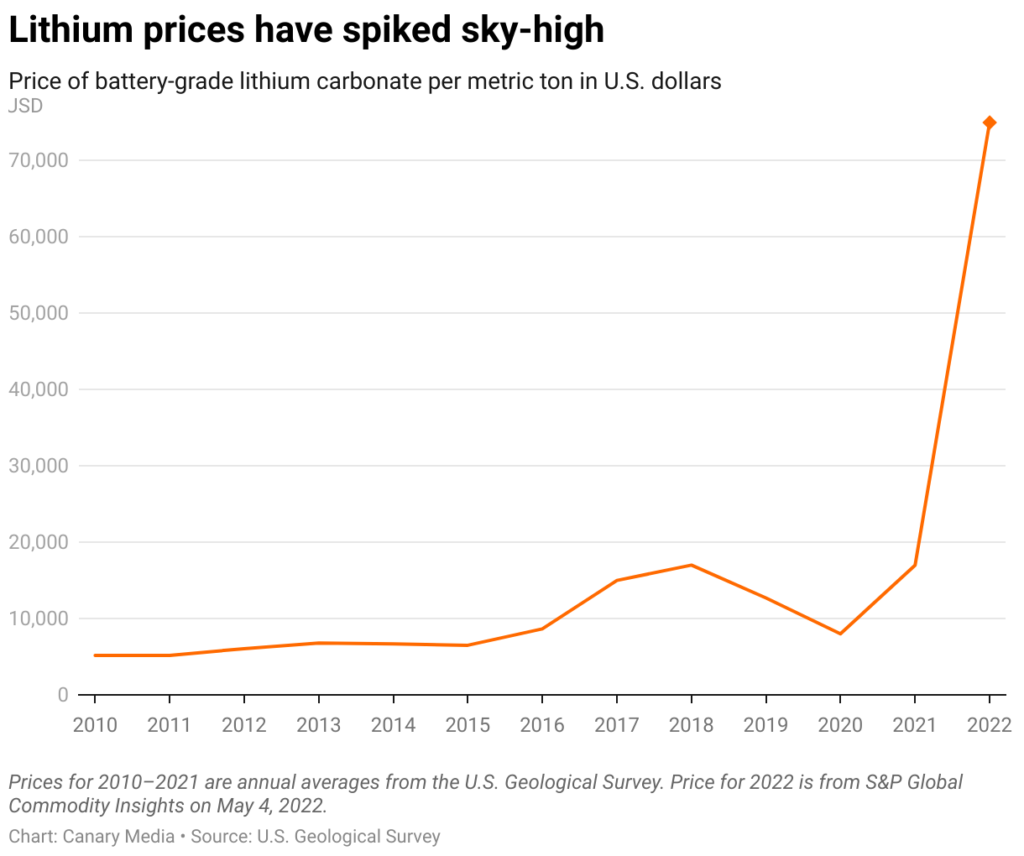

Just as the supply chain fiasco that has developed over the past year hit commodities, the metals market is virtually no different. Although, as Goldman has alluded to, prices of Nickel, Lithium, and Cobalt have seen absolutely parabolic action, resulting in absurd prices, void of nearly all fundamentals. And what goes up, must come down…right?

Goldman analysts predict that although “investors are fully aware that battery metals will play a crucial role in the 21st century global economy…” that “we [Goldman] see the battery metals bull market over for now.”

It’s not totally outlandish for there to be a cool-off in the battery metals market, as Goldman analysts point out. This is a market that his seen immense investor exuberance in the widespread adoption of electric vehicles, and not to mention insane valuations to EV manufacturers. For reference, Tesla is currently trading at a multiple of 102.5. While Tesla stock is also pretty much void of all fundamentals, it paints somewhat of a picture of how vastly overbought this whole market is.

According to analysis by Reuters, car manufacturers are planning to spend $515 Billion in battery-powered vehicles research and development, through 2030. Sentiment across the market has been a large contributor to the abnormal price action that we’ve seen, and probably some of the funny money that’s been flying around the financial system ostensibly plays a role.

Ultimately, Goldman analysts are equating the insane price action across the metals commodities as “…trading a spot driven commodity as a forward-looking equity.” I would tend to agree with this logic (although it is painful to admit). The bank claims that after prices across the three metals drop across the board, it won’t be until 2024 that they start to see gains again.