Goldman Sachs Cuts 2022 GDP Forecast to 1.75%

While Goldman Sachs will find bullish nature in just about any economic environment (much like Wall Skreet analysts), they have recently cut their GDP forecast to just 1.75%, which is a generous revision from their 3.3% estimate back in October. Goldman suggested that this revision was made “to reflect higher oil prices and other drags on growth related to the war in Ukraine.”

We have just been living in a time period where there is always some exterior factor to blame. Whether it be supply chains, the delta variant, the omicron variant, or some other “force majeure” event (you get the point). Goldman can’t admit that their originally ridiculous bullish case was fairly outlandish, to say the least. We’ve seen consumers absolutely exhausted at this point amidst a huge pileup of household debt, and not to mention the inflation story is getting uglier and uglier each month (literally everybody saw this coming).

Before the October revision, Goldman was predicting 5.0% GDP growth in Q1 2022. That number now stands at 0.5% in Q1 2022. You simply can’t replicate this macro insight anywhere else. It’s truly remarkable and that’s why they are touted as the most brilliant minds and make absolute racks.

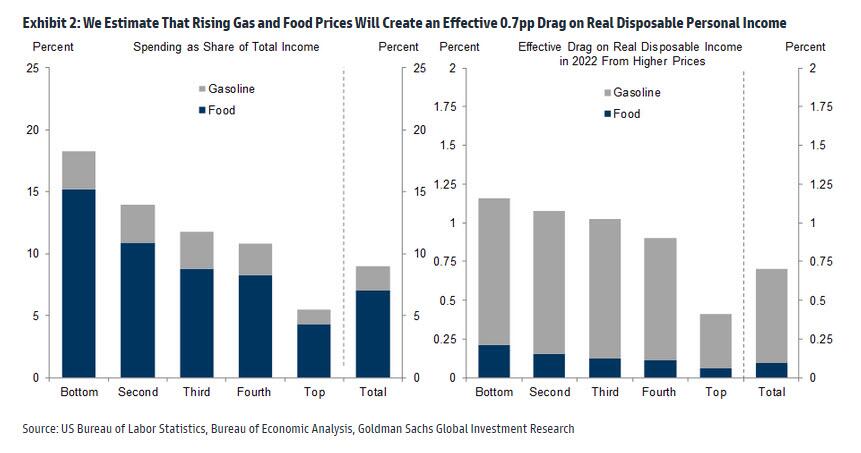

Goldman economists are claiming that the sharp rise in oil and commodities will ultimately impede consumer spending throughout the year.

Goldman is now predicting that there is a very good chance that the U.S. enters recession territory this year. Meanwhile, the U.S. Treasury Secretary and former Fed Chair Janet Yellen, says she “…[doesn’t] expect a recession in the U.S.” Albeit, as much as we tout being perma bulls, I really don’t see a bull case in this scenario. Can’t wait for the negative GDP print and double digit inflation prints (double trouble).