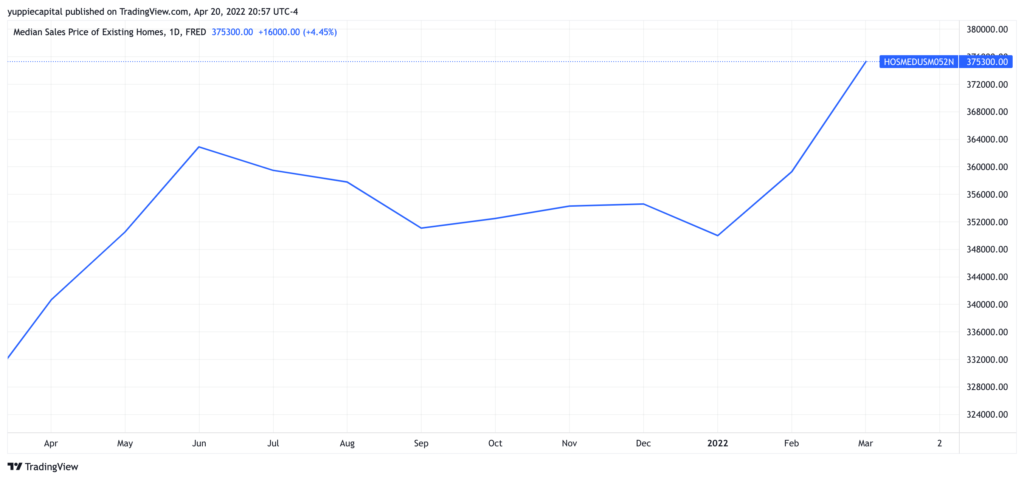

Home Prices Stay High (Pun Intended)

In stunning 4/20 fashion, U.S. home prices climbed to a fresh high of $375,300 in the month of March. As we reach a new high in home prices, demand is starting to fall.

Mortgage rates have been going absolutely nuclear since the new year, just recently climbing back to levels not seen since 2011. Although median home prices continue to climb, demand is waning very much so as record-high prices and relatively higher mortgage rates are just straight up discouraging individuals from following through on new home purchases.

The National Association of Realtors reported Wednesday that existing-home sales fell 2.7% from the month prior, and are down 4.5% from a year prior. It’s no surprise that with rising inflation, stressed equities markets, and rising mortgage rates are major headwinds for new home buyers.

The advent of the COVID-19 pandemic created the perfect storm for the housing market to book a one way ticket to outer space. With the rise in remote work, increased savings from households (which has been effectively wiped out at this point), and “booming” QE by the Fed which gave people ample opportunities to hit absolutely devious licks in the equities markets, the housing was the undeniable avenue for people to force their money into. But now, as Jeremy Grantham would say, the feel good goldilocks era is now over. You just hate to see it.

New mortgage applications are down 3% from last week, and down 14% form a year ago, according to the Mortgage Bankers Association’s seasonally adjusted index. Consumers are also feeling the wrath of the raising rate environment. 24% of consumers surveyed by Frannie Mae in March thought that now was a good time to buy a house, which happens to be the lowest on record since the survey began in 2010. Yikes.

What goes up, must come down, right? Buckle up and we’ll soon find out.