Home Sales See A 7.2% Decline

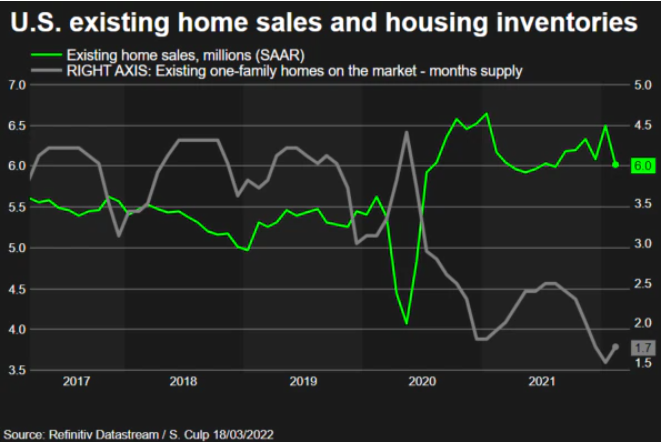

Many have faced the grim reality that realty is expensive and the prices of homes continue to increase alongside other commodities and asset classes. As of today, the HPI (Housing Price Index) is up about 18 points. In 2021, home prices skyrocketed nearly 19%, according to the S&P CoreLogic Case-Shiller home price index and Fannie Mae says home prices will climb 11.2% throughout this year, followed by a more modest increase in 2023. There is some good news however, the existing-home sales for February sank 7.2% from January. Homebuyers are getting hit with rising mortgage rates and sustained price increases according to NAR’s Chief Economist Lawrence Yun. Yun believes that the price appreciation will slow down as demand cools off and supply increases following the rise in rates.

According to Redfin’s Chief Economist Taylor Marr, homebuyers are having trouble finding smaller, more affordable homes and ultimately being priced out of the market as the growth continues. Median home prices are up about 15% from a year ago for an average of $357,300. First-time buyers made up about 29% of the market, well below the 40% average. With continued price increases, it is likely that the demand persists, even with rising costs and record inflation. Total housing inventory at the end of February 2022 equaled 870,000 units, up by 2.4% from an all-time low of 360,000 in January. An increase in cost has builders pumping the breaks a bit and will hopefully ease up the market. Good luck to anyone trying to buy a home and lord help us in all of this.