If I had a quarter for every interest rate hike…

I’d have 0 quarters. For weeks, if not months, I’ve been chirping alongside the rest of the bluebird application users about the Fed’s goal to increase interest rates in the March meeting. Today, March 2nd, the federal chair Jerome Powell stood before congress to give some insight on his plan to fight inflation.

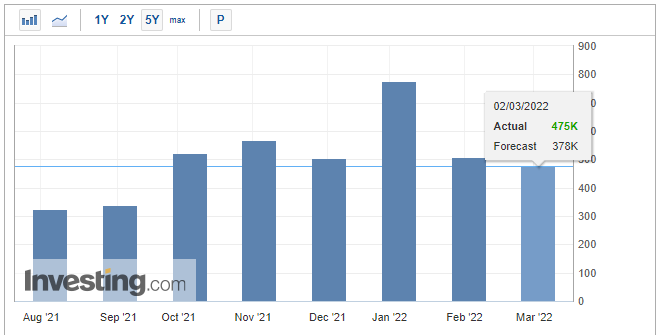

With the continuation of the Russian invasion overseas, it was unclear whether or not the federal reserve would raise rates given the environment we were put into. Today, Powell reassured congress that the plan to raise interest rates this month is on track but it’s not as bad as we expected. Previous expectations were a 50 bps hike in March but Jerome stated a quarter-point (25bps) is likely what will come into play this month. “With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month…I’m inclined to propose and support a 25 basis point rate increase,” he stated. Today’s ADP job report shows signs of life in our economy with jobs beating expectations.

The war overseas has the potential to increase inflation as the prices of oil, wheat, palladium, and other materials start skyrocketing. This puts the Federal Reserve in a difficult position when it comes to raising rates. A rate increase may lead to a decrease in economic activity, consumer spending, and job growth but a continued increase in prices may do the same. Gas is starting to increase here in California at a rapid pace and it’s keeping me from going out. I don’t want to spend the extra money to fill up my tank and burn through it all. Most Fed officials were in favor of a 50 bps hike in March but economists have agreed that the 25 bps hike is the better alternative.

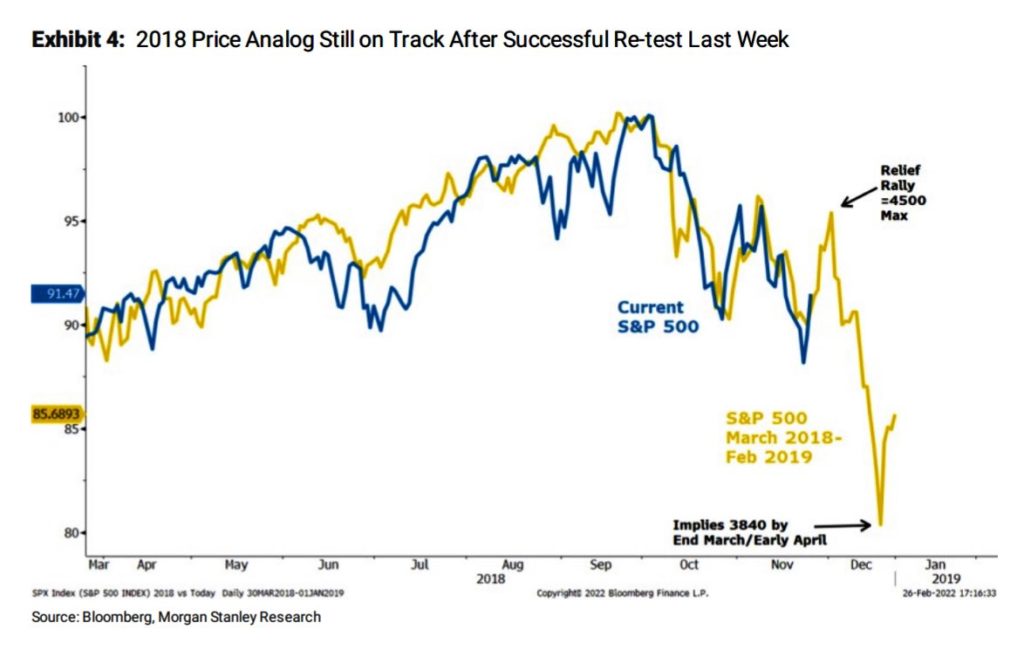

The indexes rallied today after Jerome Powell’s statement on interest rates. “Benzinga’s Take: Multiple interest rate hikes, balance sheet reductions, and global geopolitical instability are a lot for the market to digest in a single year. However, the positive trading action on Wednesday suggests investors seem to believe the U.S. economy is strong enough to overcome these headwinds and continue to grow.” (Benzinga) The continued increase in volatility is likely due to uncertainty in the market as fed officials have been on the fence and the war in Ukraine has an unclear outcome thus far. The options market has shown some glimmer of hope with March 11th 438/445 call spreads purchased yesterday into the close (OptionsHawk). The S&P is currently sitting at its downtrend and closed slightly below it. The futures market has remained quiet as well as traders wait for an opportune time to enter. Morgan Stanley analysts believe that a relief rally to 450 may be in play before another leg down to 370-80 is seen in the S&P.