Just Another Bear Rally?

In a stark contrast to the absolute abomination of capital markets in Q3, we are starting of Q4 in quite stunning fashion…but is it just a farse?

Stocks absolutely ripped right outta the gate in Q4, after an abysmal showing in Q3. In a world where bad news is good news (for capital markets at least), the long awaited JOLTs miss ostensibly sent stonks rocketing on Tuesday’s trading day. In addition to the miss on JOLTs, investors were gleaming with joy as the Reserve Bank of Australia raised rates less than expected.

The commentary regarding whether the Fed will let off on hiking this country into a recession is so dumb it actually hurts. While some would say that if you don’t think for one second that the most euphoric bull market in the entirety of the world won’t end in as much pain as there was joy, then you’re a big dumb idiot. Although, that may not entirely be the case.

As far as valuations are concerned, one could make the case that we’re at somewhat fair value across the S&P 500. Obviously, this isn’t taking into account the absolute reckoning that the Federal Reserve is about to unleash on capital markets and virtually every American household in their tyrade to fight relentless inflation (it’s the least they could do, right?).

Although, the pension crisis that developed last week in England is just a reminder of the fragility of markets at this point in time. For those unfamiliar with the matter, the BoE enacted an emergency plan to essentially bail out liquidated pension funds across the country, which also sent stonks to the moon. FREE MONEY.

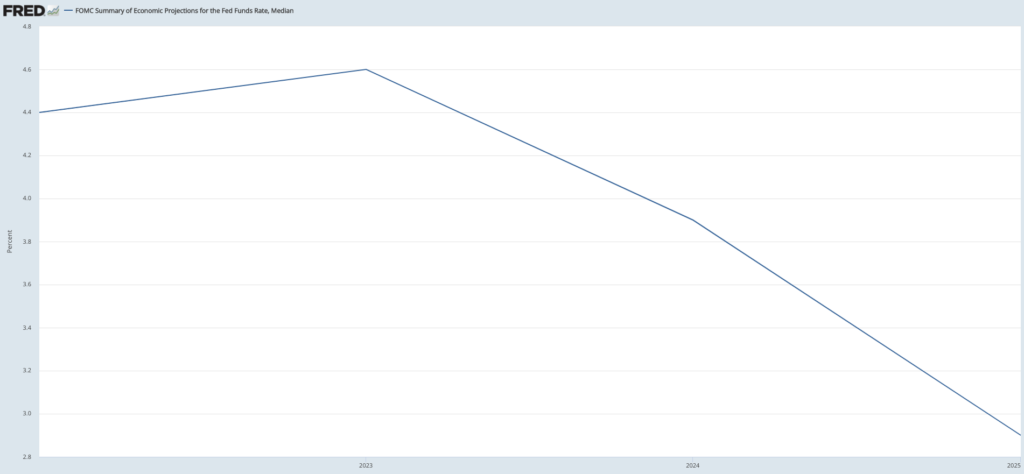

Current projections for the Effective Federal Funds Rate are showing peak rates ~4.6% in 2023, while steadily dropping to ~2.6% by 2025. The Fed is doing quite literally everything in their power to only inflict a mild recession on Americans, although a recession nonetheless is likely inevitable. While we likely aren’t in for a full blown financial crisis like that prompted by the housing bubble in 2008, the one unknown variable at play is the outstanding treasury debt in play, relative to other recessions. This risks seizing up treasury and credit markets, which was once an oasis of liquidity, is now akin to the god damn Sahara Desert.