Long Crypto Liquidations En Bloc

Monday’s trading session was anything but a doozy. The NASDAQ traded over 2% lower on the day, S&P down 1.69%, and the DOW following not too far behind at just over 1%. But the star of the show was the crypto market, which bled so horrendously it was almost painful to watch.

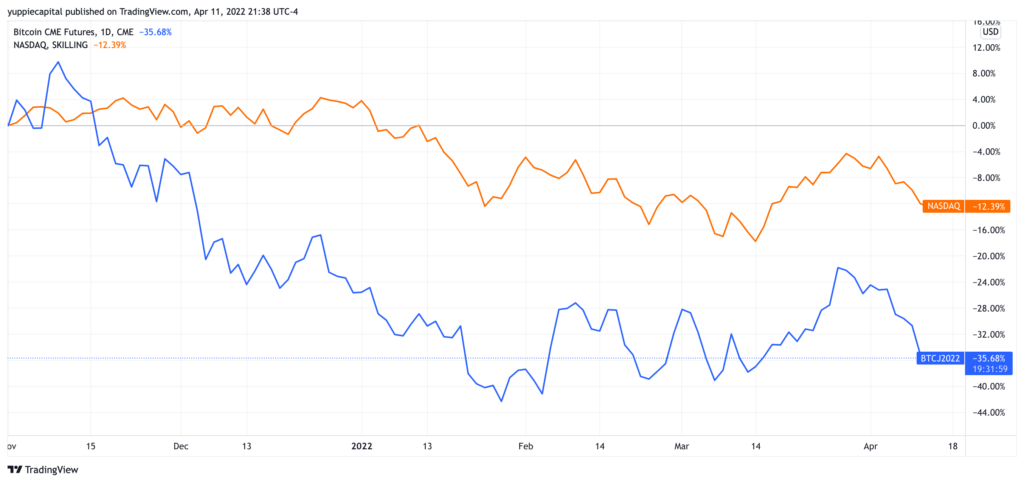

Bitcoin was trading ~$42k in the early morning, and didn’t take long to absolutely hemorrhage, and trade ~$39k. Bitcoin is currently down over 40% from its peak in November, with equities down only (not that this is a small percentage loss by any stretch of the imagination ) 16% from November highs.

Traders ostensibly continued their selling of speculative assets (i.e. equities, crypto) amongst a frenzy surrounding the uncertainty of the future economy, and inflation punishing just about everyone and their mother. Yields continue to rise across the boards as the bond market shows no signs of slowing down its aggressive collapse. The 10Y yield climbed to a fresh, three year high of 2.78%. And surprise, surprise, the 30Y mortgage rate climbed even higher, settling at 4.72%, levels not seen since December 2018.

Alt coins appeared to have faced the worst of the crypto storm, with Chainlink trading 8% lower on the day, and Solana trading nearly 10% on the day. Although the crypto liquidation storm was somewhat decent today, it certainly wasn’t the worst they’ve seen in recent months. Long liquidations were rampant through the month of January, and in late February & early March.

Also just to put the poopy icing on the poopy cake, our favorite entrepreneur and favorite “rich dad” Robert Kiyosaki came out today and said how inflation would destroy 50% of the U.S. population. So if you aren’t getting rekt via the equities markets, crypto markets, or bond markets, it’ll be inflation that gets you. I guess he’s not that far off, tbh.

Good luck out there, everyone. There is blood in the streets, and lots of it.