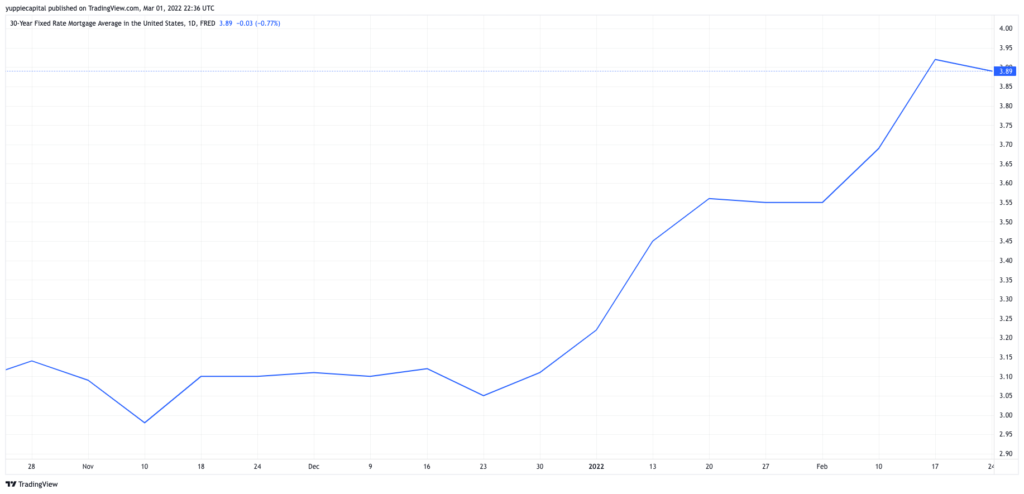

Mortgage Rates Extend Decline in Largest Two-Day Drop Since March 2020

Welp, as somewhat of a surprise to me, the 30Y Fixed Rate Mortgage dropped to 3.89% on Tuesday, after retreating from 4.18% to 4.04% on Monday. But you can’t predict the future. If i knew about the imminent Russian invasion into Ukraine, I would have predicted this! (facetiously). We haven’t heard any word yet on the Fed Taper, but as far as we know, they are still keeping pace with their plan of reducing MBS and U.S. Treasury Debt purchases.

As has been the catalyst for virtually every financial event we’ve covered over the last couple weeks (the Ruble tanking, oil going nuclear, etc.) the Russian invasion of Ukraine is spooking the bond market (unless it’s the Russian bond market), and rates across the board were down. The 10-year Treasury also fell during Tuesday’s trading session.

The rise in mortgage rates have arguably been arising due to the slowdown in MBS purchasing from the Fed (which will come to an end unfortunately), and then the eventual rate hikes which will also rear their ugly heads.

Ostensibly, this short downward trend should be relatively short lived. That is, however, contingent on how abysmal the situation in Ukraine becomes. Putin has been sanctioned unbelievably hard, and still moves on as if nothing has happened.

Will this short term drop in rates continue to fuel this housing market? It could. I think it ultimately depends on what the levels are looking like over this week. The housing market is still presumably strong, and buyers haven’t been too discouraged…yet. I just can’t wait for Jerome Powell to make his grand entrance on live television and announce QE Infinity as a result of the economic repercussions in lieu of the Ukrainian crisis. Book it, baby.