Natural Gas Is Absolutely Boomin’

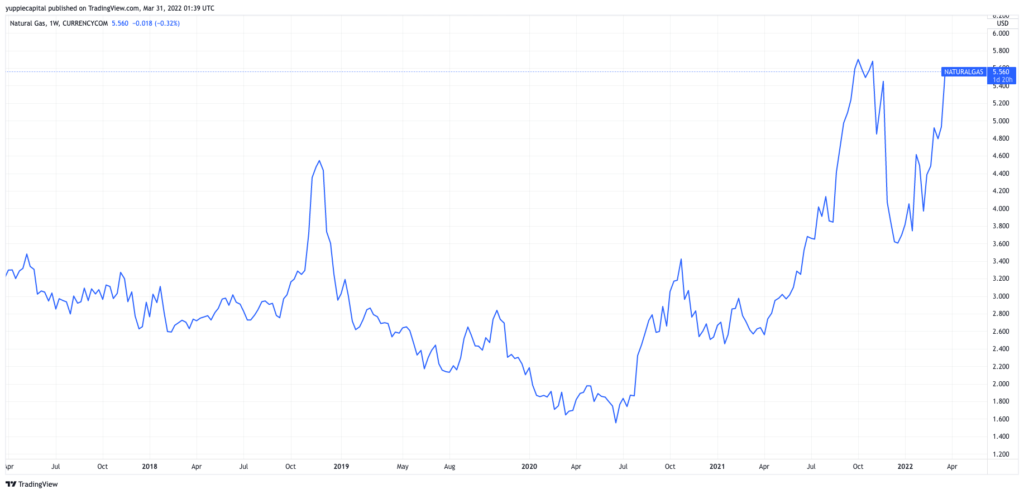

Metro Boomin make it booooooom. As Wall Skreet analysts pointed out late last week, the U.S. is sending their natural gas shipments overseas absolutely crazily. This shift in production and export is sending the price of natural gas unusually high, as the spring time is when price levels typically fall. Gas producers use this time to stash supplies as the colder weather subsides and demand eases. 1W Natural Gas futures climbed to $5.560 per million BTUs. That’s more than twice the price we saw at this time a year ago.

According to senior commodity strategist Ryan Fitzmaurice, “We are in a new phase for U.S. gas markets.” Oil and gas executives responded the a recent Fed survey by expecting that natural gas prices were likely to finish the year around $4.57 per MMBtu. You hate to see it.

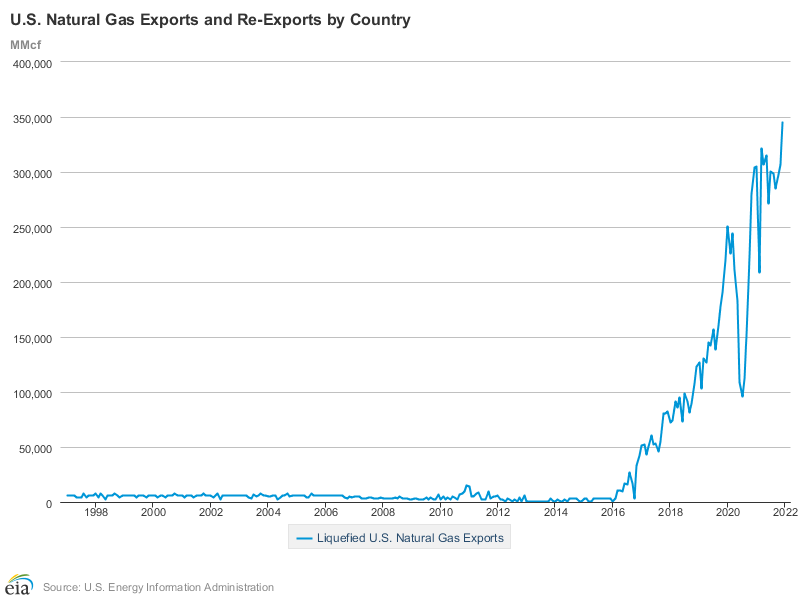

In the emergence of shale drilling, we’ve also seen a recent trend of increased exports of liquified natural gas (LNG) from the U.S. to outside countries. This explosion came to an abrupt drop off in the onset of the COVID-19 pandemic, with demand for U.S. LNG surging back with a vengeance.

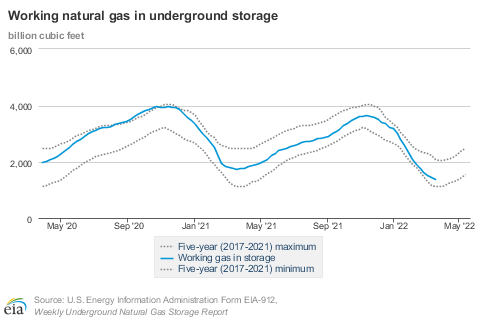

With the Russia and Ukraine situation escalating, and Biden exercising his efforts to reduce European reliance on Russian oil & gas, U.S. natural gas in underground storage is nearly below the five year minimum range.

All of this in the name of decreased emissions and reduced fossil fuel dependence? I’ll say this again for the third time but the COP26 Climate Summit was literally for nothing. We expend energy by pulling a fossil fuel from the ground, expend energy to liquefy and package it, and then expend more energy to ship it across the world.

Is it also by chance that the Northeast has seen a massive cold front this past week? Impeccable timing if you ask me.