NFT Market in Shambles

Last March, a man made headlines within the crypto realm as he spent a whopping $2.9 Million on an NFT of Jack Dorsey’s (Twitter co-founder) first ever tweet, which read “just setting up my twttr”.

However, despite having the most asinine bullish expectation on the “asset” purchase, Sina Estavi is expected to take a 99% loss on the investment, with the current highest bid at the moment coming in at *drumroll*

…

$30,739.

In an interview with Reuters, Estavi said, “It is important to me who wants to buy it. I will not sell this NFT to anyone because I do not think everyone deserves this NFT.” It’s honestly quite hard to conceptualize the pure delusion that is running amok in this man’s head. He really had the audacity to highlight the exclusivity of the clientele as to which he would solicit offers from, blissfully unaware of how awful of an “investment” this really was.

Estavi listed the token on Opensea, where he was expecting the sale price to land somewhere around ~$50 Million, with the intention of donating 50% to charity. You can’t knock the man’s high hopes and dreams, and my god were they HIGH. It’s also important to note that former Twitter guru Jack Dorsey made out like an absolute BANDIT in this sale. You can’t teach that type of business acumen.

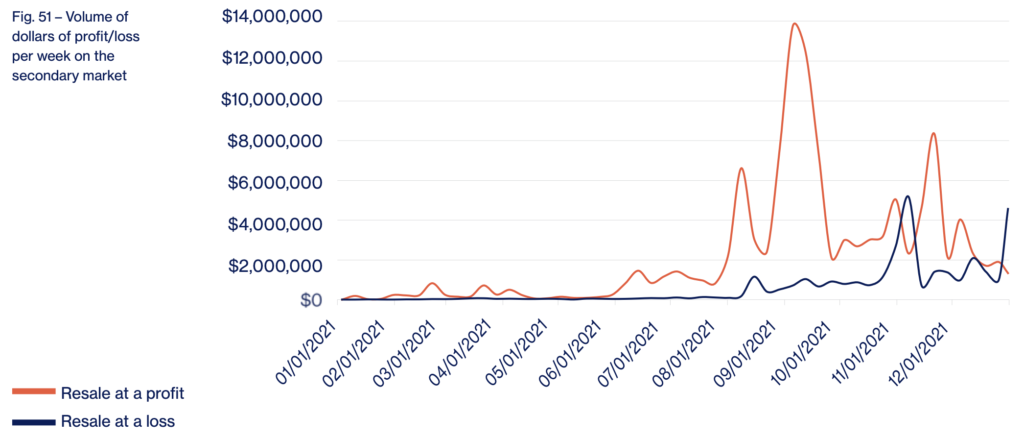

The NFT market absolutely exploded in 2021. According to data collected via NonFungible.com, total volume of dollars traded in 2021 clocked in at $17,694,851,721. This alone just goes to show there was simply too much money flying around the global financial system. The average price for an NFT sold in 2021 was $807.52, up from just $49.18 the year before. According to a WSJ report, global monthly sales of NFT sales totaled nearly $5 Billion in August. In March, that number came in at $2.4 Billion, citing data collected by CryptoSlam, Inc.

Although this man may hold the world record for “world’s largest bagholder”, I do have to give credit where credit is due. This man really did embody the Wall Skreet investing zeitgeist “Buy High, and Hope to God it Goes Higher.”