Not around the corner, but down the block.

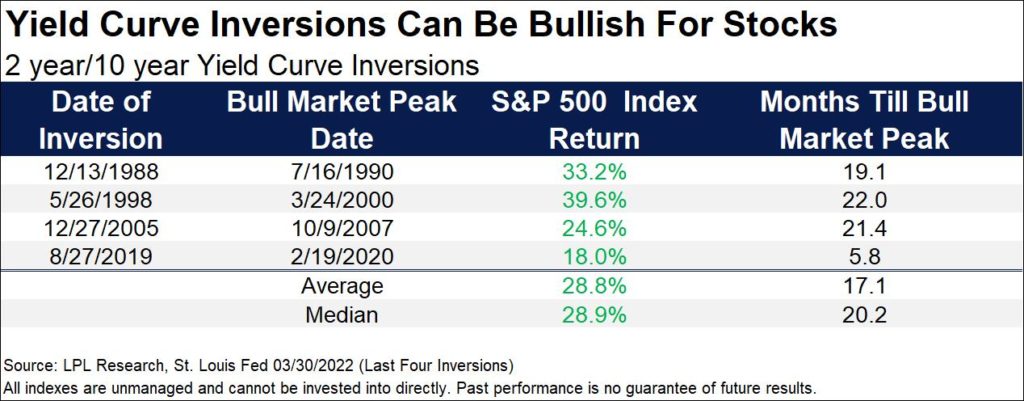

As the world continues to burn, Ukraine continues to try and break free of Russian ties, and the price of my coffee continues to rise, what else could go wrong? Well for the first time since 2006, the 2-year Treasury yield briefly surpassed that of the 10-year note for the first time in almost three years. From 2006 to 2007, leading up to the global recession, the yields did this. While the Federal Reserve is doing its best (kinda) to fight inflation, it may not be enough. Citi Group believes that the Fed will hike by 50 bps during the next four meetings.

Famed investor Carl Icahn is well prepared for a recession with the expectations of serious economic turmoil as the economy battles inflation and the ongoing war. “Icahn pointed to high inflation in particular as an alarming new trend, noting that supply-chain issues continue to persist, and controlling rising prices isn’t always an easy feat.”(CNBC) Ichan also criticized the retail frenzy that has entered the markets that mimic gambling as opposed to strategy. Just this past week the “meme” craze took Wallstreet by surprise as AMC & GME posted large gains to start the week. “You have a lot of people in this market, I think more than I’ve ever seen, who have no idea what they’re doing,” the billionaire investor said. “The market is not a gambling casino completely…There are people in this market that do have an edge, and you have so many people out there that really are gambling.”

To start the month off, the S&P was down 13% from its all-time highs and now we are only down 3.7%. If you had asked an investor if a recession was likely a few weeks ago, they’d likely say yes, but if you ask them now they wouldn’t know what the word meant. Data continues to show strong demand for workers and consumer spending remains intact despite the rising costs for basic necessities. The Federal Reserve believes the economy is strong enough to withstand higher interest rates without taking a significant loss. For March, the labor market is expected to gain 490,000 jobs, making it 11 months of gains above 400,000. Unemployment feels non-existent as the rate sits at 3.8% as of February. Consumer spending is the biggest factor here, with most Americans unphased by the increase in price it is hard to say a recession is around the corner. Is it down the block?

A recession is likely to come in the future based on record inflation, large hedge funds positioning defensively, and an inverted yield curve. The real pressure will come when economic activity slows down but that doesn’t seem to be anytime soon. Throughout the pandemic (bandemic), many Americans were locked in their homes waiting for the chance to drive to the store just to get some sunlight but with covid restrictions being lifted, mandates beginning to ease, and cash burning a hole in their pockets, consumer sentiment is resilient. This coincides with companies in need of workers to fulfill the needs of their customers and the cycle continues. The largest benefit of this is that employees seem to have an advantage at the moment with some individuals starting their own businesses and no longer working under “the man”. This allows the remaining laborers to leverage their benefits and pay throughout the current climate but at some point, it does come to an end and I would assume it is in a year when everyone has had their outings and has run out of money. Cash flow will ease and demand will slowly diminish, at least compared to current levels, likely shocking the economy. In the markets, the indexes prepared for the worst and we saw VIX trade above 30 for the first time since last January & December. To kick the year off we faced multiple market-moving events, and still will in the future, like rate hikes, invasions, and inflation but once that all passed, the VIX was demolished thus adding more upside to a bounce, i.e. the last two weeks. So when someone says that the recession is coming, it probably is, but not in the near term.