Outflows in U.S. Equities Continues – You Hate To See It

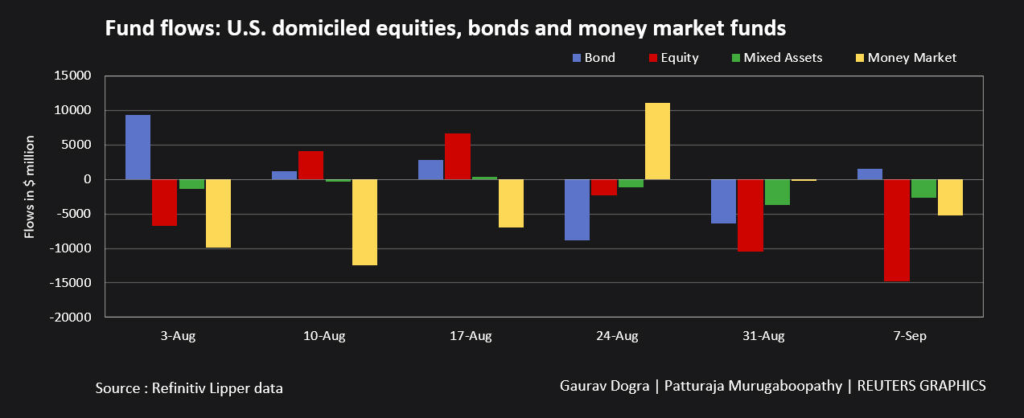

THE OUTFLOWS CONTINUE. According to data published by Refinitiv Lipper, investors withdrew $14.83 Billion out of U.S. equity funds, which is the largest outflow since June 15.

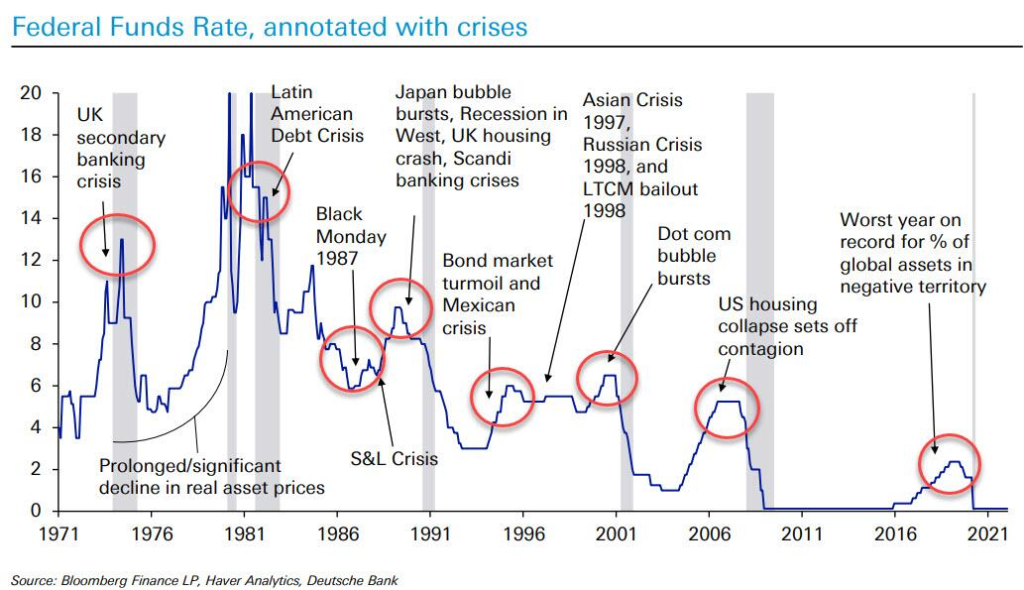

We may be seeing the tides turn in U.S. equities after a rough start into 2022. American stocks are especially more susceptible to capital outflows given the shrinkage (I WAS IN THE POOL) in the financial system via Federal Reserve induced quantitative tightening.

Diminishing liquidity in the financial system will be a very important driver of asset prices, specifically risk-on assets. Given Fed hawkishness, investors will ostensibly rotate to a risk-off trade, piling into bonds, gold, and maybe…the Japanese Yen? Risk assets will be under much more duress as bid/ask accentuation can absolutely hammer valuations. THERE WILL BE BLOOD IN THE STREETS.

In addition to a more illiquid environment in the onset of QE, asset price valuations have also been largely driven via astronomically minute interest rates. Borrowing costs being so low have exacerbated the rate as to which money is flying across the global financial system. People who have no business assuming debt are riding the euphoria induced wave and have just been signing their lives away. For what it’s worth, U.S. household debt currently sits at $16.15 Trillion at the end of Q2 2022. That is just a truly beautiful thing.

Ain’t that America?