Robinhood Firing 9% of Full Time Employees

Vlad the terrible strikes again. After a litany of layoffs have stricken the mortgage lending business (everyone remembers the infamous video of the Better.com CEO laying off 900 employees via a Zoom call), layoffs are hitting the most popular brokerage app and retail favorite, Robinhood. Before we get into the Robinhood story let’s just take a look at arguably the most iconic video of all time.

Vlad Tenev (Robinhood CEO) shared this message to fellow Robinhood employees after an all-hands meeting which discussed the changes.

After carefully considering all these factors, we determined that making these reductions to Robinhood’s staff is the right decision to improve efficiency, increase our velocity, and ensure that we are responsive to the changing needs of our customers,” said Tenev (via Bloomberg).

Robinhood has been touting their renowned leadership in the commission-free trading realm, but the reality is that their user base is slowing, and their grandeur hopes were bound to come to a grinding halt, and it appears that their time has finally come. Robinhood recently announced that they would extend their trading hours, in hopes of attracting new users to their platform (I used the term idiot in my blog post, but you get the point).

The company has clearly been struggling since they amassed a record breaking user base in the onset of COVID and some fresh direct liquidity injection via Jerome Powell at the Fed. Their past two quarters the company missed both on revenue and earnings projections (let it be known that they missed Q3 2021 EPS by a whopping 177%, lol).

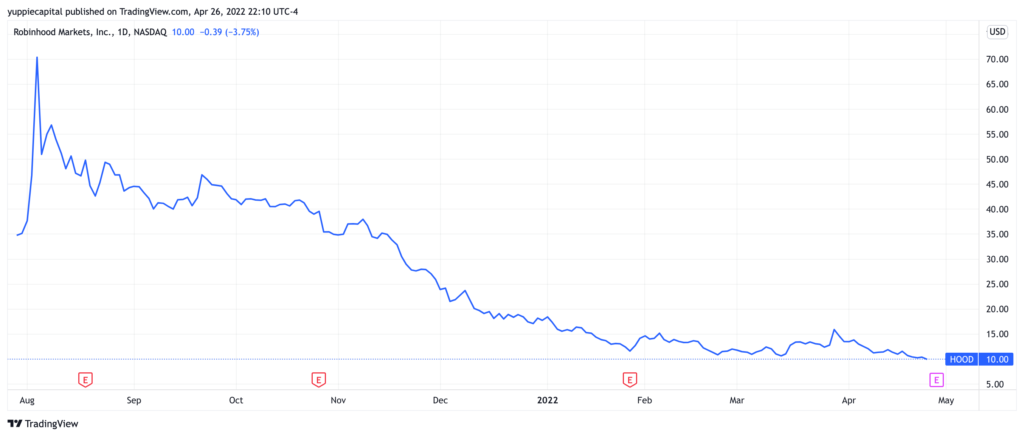

Robinhood is down over 70% from their IPO price (oh, the irony), and down nearly 86% from their ostensibly rigged highs back in August 2021.

If truth be told, I had closed my Robinhood account in lieu of the GameStop and AMC fiasco, where they restricted trading in what according to them was to meet “clearinghouse requirements”, although I think the jury is still out on this issue. In any case, while first and foremost I thought Vlad was a total fraud, I was also genuinely concerned regarding the brokerage’s solvency in light of the whole controversy, which eventually drew a congressional hearing after the situation came to light. In any case, I’m sure that Robinhood’s user base will continue to decline, especially in an ostensible lack of stock market involvement with equities very much so in correction territory. I think it’s safe to say, ttyl Robinhood.