SoftBank Doing SoftBank Things

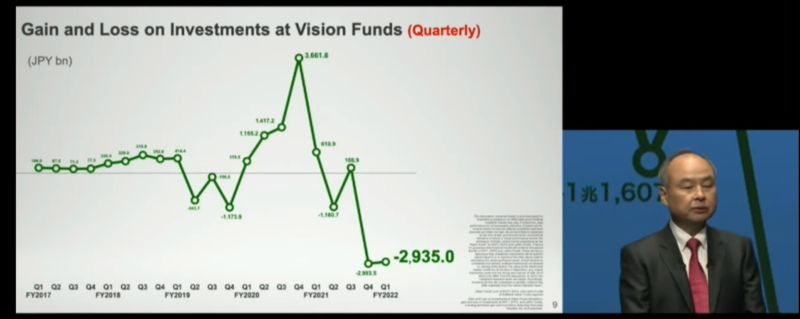

The infamous SoftBank breaking records yet again. The tech investor reported their largest quarterly loss ever, coming in at a cool $23.4 Billion loss for Q2. Excellent job, guys. Per usual, Masayoshi Son (SoftBank CEO) is finding another way to just astound investors in the worst possible way. The company’s startup investment syndicate (Vision Fund), has been the culprit (shocker) for the company’s lackluster performance. Speaking of VISIONaries…haha…SoftBank’s stock has tracked eerily similarly to Cathie Wood’s ARK Innovation ETF. Both made astronomical gains in Q1 2021, only to just absolutely puke thereafter. SoftBank’s stock is down nearly 58% from those highs, while ARKK is down almost 68%. Much Vision.

The SoftBank Vision Fund has incurred losses from some of the darling pandemic-era stocks, including: DiDi (just recently delisted on U.S. exchanges), Klarna Bank, and Compass Inc., just to name a few. The SoftBank CEO also came out with arguably the most goated explanation of all time. I actually have to give him credit for being honest, because we’ve all been there when the money is hot and heavy and flying around like it’s nobody’s business. He’s quoted as saying, “When we were turning out big profits, I became somewhat delirious, and looking back at myself now, I am quite embarrassed and remorseful.” Honestly? Respectful. But, L + ratio + rekt + don’t care, didn’t ask + cope.

The broad sell-off in tech has continuously weighed on the firm, and exacerbated losses. The fairy tale market valuations that existed alongside ZIRP & QE infinity are now revealing a very sobering reality. According to Mr. Son, their flagship Vision Fund approved just $600 Million in new investments this past quarter, compared to $20.6 Billion in Q2 2021. I don’t even know where to begin. The numbers just speak for themselves.

The investment company is not only struggling with losses financially within the company, but via manpower as well. Several C-Suite have recently made the exile out of the company. Earlier this year, Chief Operating Officer Marcelo Claure left the company (on ostensibly less than ideal terms). Former Chief Strategy Officer Katsunori Sago also left the company last year. And to put the icing on the cake, the long-running maestro (Rajeev Masra) of the Vision Fund is stepping away, leaving Mr. Son bearing most of the responsibilities of managing the struggling fund.

It’s clear that Mr. Son has an astronomical task at bay. My man has to turn around record losses in a seemingly tumultuous era for capital markets. Dissatisfied investors, a fleeing C-Suite, and recessionary headwinds are setting the stage for a “nut up, or shut up” moment for Mr. Son. YOU CAN EITHER BE A HERO, OR A ZERO.