Supply Chain Crisis – Remastered

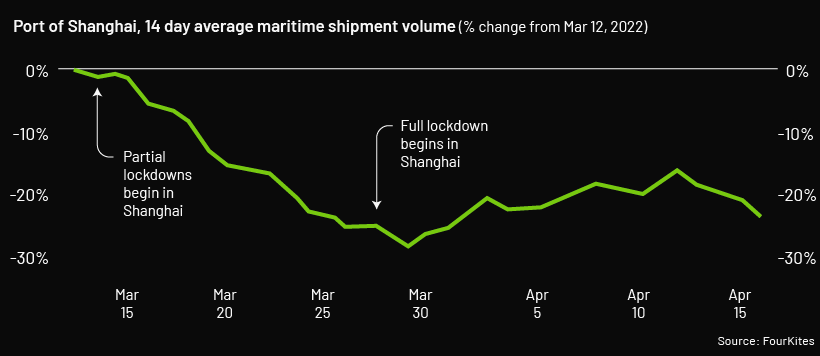

Ever since the “Great Texas Freeze of ’21“, the supply chain crisis intensified throughout the remainder of the year, and analysts are positing that we’re due for the next round this summer. China’s “zero COVID” policy has created nuclear congestion, and once free, will ostensibly create an absolute free-for-all that will clog any and all egress points.

FreightWaves CEO Craig Fuller so eloquently stated that the reopening of China and resuming shipping will “wreck your summer” in a Twitter post.

Shanghai happens to be the largest manufacturing entities in all of China. They tout the largest container port globally, with provisions for inbound as well as outbound air cargo. Spanish financial firm BBVA reports that 20% of China’s export container throughput proceeds through there.

Although we are entering a slowing economy with astronomical inflation, this just adds to the laundry list of factors that will adversely effect the macro outlook for 2022. Inflation continues to run rampant, consumer confidence is nearing historic lows, and we are entering a totally different monetary framework than what was in place just a year ago (QE Infinity gone, but never forgotten). Even before the new Shanghai “zero-COVID” provisions just recently put into place, Goldman Sachs revised their GDP outlook for 2022 to a measly1.75% (sad). Roaring Twenties – Remastered?