Tech Layoffs En Masse

Despite a rather “robust” (jury is still out) labor market, the likes of the tech sector have certainly seen better days. Over the past few weeks, tech companies have been reporting plans to reduce their workforces, with borrowing costs and prices in general trending higher.

Just today, Klarna announced their plan to lay-off 700 employees, roughly 10% of their workforce. This move comes just a week after the Wall Street Journal reported that the company would cut their valuation in search of new capital to raise. This comes after the startup company was touted as Europe’s most valuable fintech company when SoftBank valued them at $45.6 Billion back in June. How the turntables…

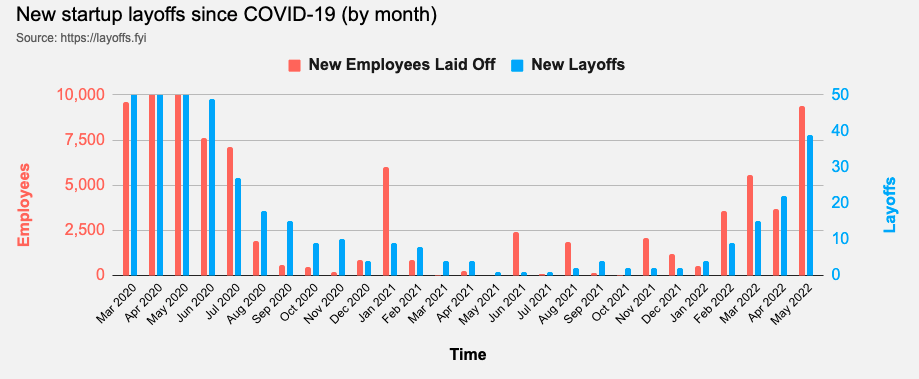

According to data sourced from Layoffs.fyi, an online tool which tracks tech startup layoffs since the beginning of the pandemic, there have been a total of 9,370 employees laid of this May alone. The previous month which broke this record was two whole years ago in May of 2020. This, of course, was before we had an additional ~$2.3 Trillion injected into the financial system by out friends at the Federal Reserve.

Recession fears are growing, inflation remains persistent (albeit the worst has likely already come), and equities markets are treading a very fine line into bear market territory (up bigly in today’s trading session as volatility shows no signs of subsiding). The tech-heavy NASDAQ has shed nearly 30% from it’s highs back in November 2021. The risk-off trade is very real right now, and the tech sector is absolutely reeling.

The tech sector has seen absolutely enormous growth over the past two decades. Tech startups have benefited greatly from venture capital and private equity funding. Let’s note that VC funding is down 13% form quarter to quarter in the first three months of 2022, according to crunchbase.com. That, in addition to favorable economic conditions facilitated by the Federal Reserve in the onset of the pandemic, has led to astronomical valuations, that have been achieved nearly entirely on the basis of these companies’ fair value is calculated using a near zero EFFR. What happens when the Fed decides to raise rates? Valuations fall. It’s the perfect macro storm which will likely push the tech layoff saga more aggressively in future months. “The increase in discount rates corresponding with market volatility has led to a fundamental repricing of valuations and a sharp rotation away from stocks with relatively high implied growth rates towards stocks with relatively low growth rates,” says Andrew Akers (analyst in the quantitative research group at PitchBook).